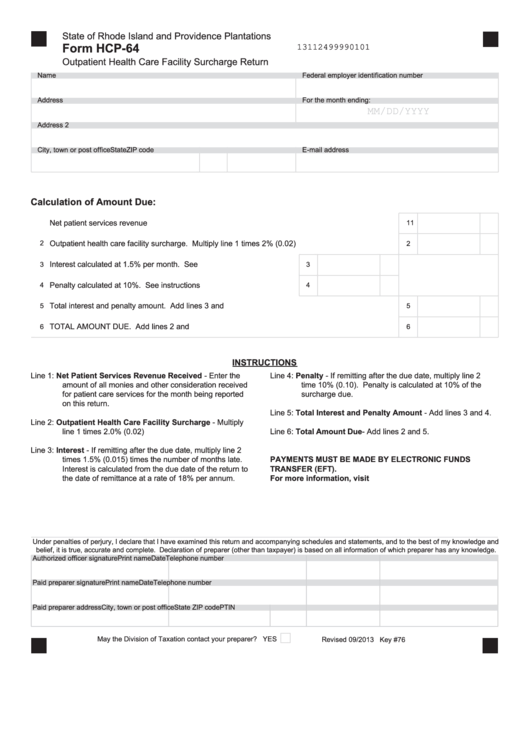

State of Rhode Island and Providence Plantations

Form HCP-64

13112499990101

Outpatient Health Care Facility Surcharge Return

Name

Federal employer identification number

Address

For the month ending:

MM/DD/YYYY

Address 2

City, town or post office

State

ZIP code

E-mail address

Calculation of Amount Due:

Net patient services revenue received.....................................................................................................

1

1

2

Outpatient health care facility surcharge. Multiply line 1 times 2% (0.02)..............................................

2

Interest calculated at 1.5% per month. See instructions..........................

3

3

4

Penalty calculated at 10%. See instructions ...........................................

4

Total interest and penalty amount. Add lines 3 and 4.............................................................................

5

5

TOTAL AMOUNT DUE. Add lines 2 and 5..............................................................................................

6

6

INSTRUCTIONS

Line 1: Net Patient Services Revenue Received - Enter the

Line 4: Penalty - If remitting after the due date, multiply line 2

amount of all monies and other consideration received

time 10% (0.10). Penalty is calculated at 10% of the

for patient care services for the month being reported

surcharge due.

on this return.

Line 5: Total Interest and Penalty Amount - Add lines 3 and 4.

Line 2: Outpatient Health Care Facility Surcharge - Multiply

line 1 times 2.0% (0.02)

Line 6: Total Amount Due - Add lines 2 and 5.

Line 3: Interest - If remitting after the due date, multiply line 2

times 1.5% (0.015) times the number of months late.

PAYMENTS MUST BE MADE BY ELECTRONIC FUNDS

Interest is calculated from the due date of the return to

TRANSFER (EFT).

the date of remittance at a rate of 18% per annum.

For more information, visit .

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP code

PTIN

May the Division of Taxation contact your preparer? YES

1

1