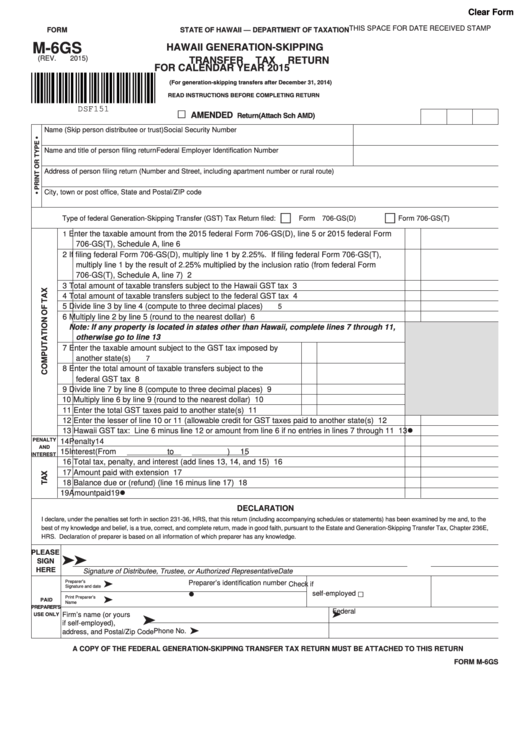

Clear Form

THIS SPACE FOR DATE RECEIVED STAMP

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

HAWAII GENERATION-SKIPPING

M-6GS

TRANSFER TAX RETURN

(REV. 2015)

FOR CALENDAR YEAR 2015

(For generation-skipping transfers after December 31, 2014)

READ INSTRUCTIONS BEFORE COMPLETING RETURN

DSF151

AMENDED Return (Attach Sch AMD)

Name (Skip person distributee or trust)

Social Security Number

Name and title of person filing return

Federal Employer Identification Number

Address of person filing return (Number and Street, including apartment number or rural route)

City, town or post office, State and Postal/ZIP code

Type of federal Generation-Skipping Transfer (GST) Tax Return filed:

Form 706-GS(D)

Form 706-GS(T)

Enter the taxable amount from the 2015 federal Form 706-GS(D), line 5 or 2015 federal Form

1

706-GS(T), Schedule A, line 6

1

2

If filing federal Form 706-GS(D), multiply line 1 by 2.25%. If filing federal Form 706-GS(T),

multiply line 1 by the result of 2.25% multiplied by the inclusion ratio (from federal Form

706-GS(T), Schedule A, line 7)

2

3

Total amount of taxable transfers subject to the Hawaii GST tax

3

4

Total amount of taxable transfers subject to the federal GST tax

4

5

Divide line 3 by line 4 (compute to three decimal places)

5

6

Multiply line 2 by line 5 (round to the nearest dollar)

6

Note: If any property is located in states other than Hawaii, complete lines 7 through 11,

otherwise go to line 13

7

Enter the taxable amount subject to the GST tax imposed by

another state(s)

7

8

Enter the total amount of taxable transfers subject to the

federal GST tax

8

9

Divide line 7 by line 8 (compute to three decimal places)

9

10 Multiply line 6 by line 9 (round to the nearest dollar)

10

11 Enter the total GST taxes paid to another state(s)

11

12 Enter the lesser of line 10 or 11 (allowable credit for GST taxes paid to another state(s)

12

13 Hawaii GST tax: Line 6 minus line 12 or amount from line 6 if no entries in lines 7 through 11

13

PENALTY

14 Penalty

14

AND

15 Interest (From

to

)

15

INTEREST

16 Total tax, penalty, and interest (add lines 13, 14, and 15)

16

17 Amount paid with extension

17

18 Balance due or (refund) (line 16 minus line 17)

18

19 Amount paid

19

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including accompanying schedules or statements) has been examined by me and, to the

best of my knowledge and belief, is a true, correct, and complete return, made in good faith, pursuant to the Estate and Generation-Skipping Transfer Tax, Chapter 236E,

HRS. Declaration of preparer is based on all information of which preparer has any knowledge.

PLEASE

SIGN

HERE

Signature of Distributee, Trustee, or Authorized Representative

Date

Preparer’s

Preparer’s identification number

Check if

Signature and date

self-employed

Print Preparer’s

PAID

Name

PREPARER’S

Federal

USE ONLY

Firm’s name (or yours

E.I. No.

if self-employed),

Phone No.

address, and Postal/Zip Code

A COPY OF THE FEDERAL GENERATION-SKIPPING TRANSFER TAX RETURN MUST BE ATTACHED TO THIS RETURN

FORM M-6GS

1

1 2

2