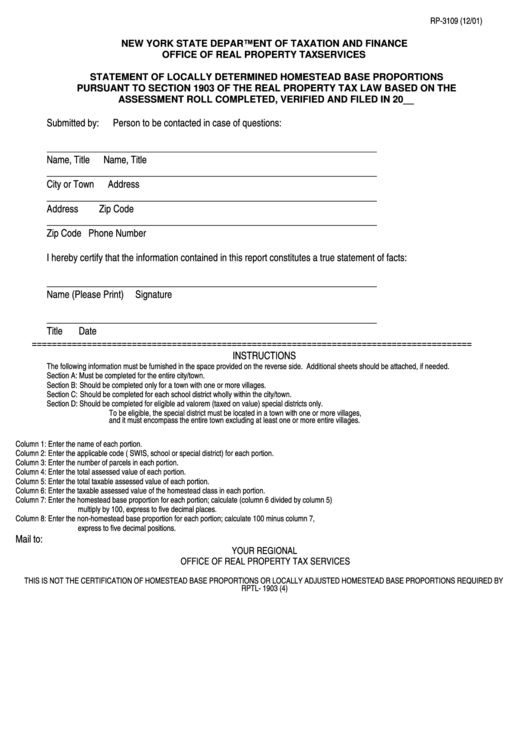

RP-3109 (12/01)

NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

STATEMENT OF LOCALLY DETERMINED HOMESTEAD BASE PROPORTIONS

PURSUANT TO SECTION 1903 OF THE REAL PROPERTY TAX LAW BASED ON THE

ASSESSMENT ROLL COMPLETED, VERIFIED AND FILED IN 20__

Submitted by:

Person to be contacted in case of questions:

_________________________________

____________________________________

Name, Title

Name, Title

_________________________________

____________________________________

City or Town

Address

_________________________________

____________________________________

Address

Zip Code

_________________________________

____________________________________

Zip Code

Phone Number

I hereby certify that the information contained in this report constitutes a true statement of facts:

_________________________________

____________________________________

Name (Please Print)

Signature

_________________________________

____________________________________

Title

Date

========================================================================================

INSTRUCTIONS

The following information must be furnished in the space provided on the reverse side. Additional sheets should be attached, if needed.

Section A: Must be completed for the entire city/town.

Section B: Should be completed only for a town with one or more villages.

Section C: Should be completed for each school district wholly within the city/town.

Section D: Should be completed for eligible ad valorem (taxed on value) special districts only.

To be eligible, the special district must be located in a town with one or more villages,

and it must encompass the entire town excluding at least one or more entire villages.

Column 1: Enter the name of each portion.

Column 2: Enter the applicable code ( SWIS, school or special district) for each portion.

Column 3: Enter the number of parcels in each portion.

Column 4: Enter the total assessed value of each portion.

Column 5: Enter the total taxable assessed value of each portion.

Column 6: Enter the taxable assessed value of the homestead class in each portion.

Column 7: Enter the homestead base proportion for each portion; calculate (column 6 divided by column 5)

multiply by 100, express to five decimal places.

Column 8: Enter the non-homestead base proportion for each portion; calculate 100 minus column 7,

express to five decimal positions.

Mail to:

YOUR REGIONAL

OFFICE OF REAL PROPERTY TAX SERVICES

THIS IS NOT THE CERTIFICATION OF HOMESTEAD BASE PROPORTIONS OR LOCALLY ADJUSTED HOMESTEAD BASE PROPORTIONS REQUIRED BY

RPTL- 1903 (4)

1

1 2

2