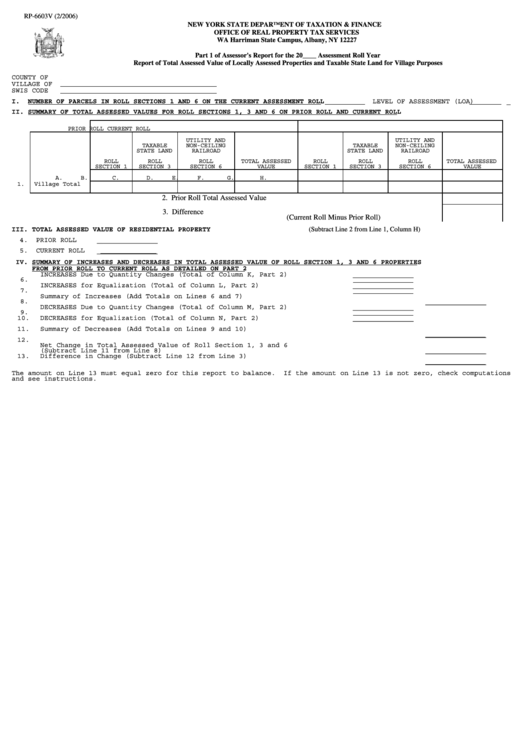

Form Rp-6603v - Report Of Total Assessed Value Of Locally Assessed Properties And Taxable State Land For Village Purposes

ADVERTISEMENT

RP-6603V (2/2006)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

WA Harriman State Campus, Albany, NY 12227

Part 1 of Assessor's Report for the 20____ Assessment Roll Year

Report of Total Assessed Value of Locally Assessed Properties and Taxable State Land for Village Purposes

COUNTY OF

VILLAGE OF

SWIS CODE

I.

NUMBER OF PARCELS IN ROLL SECTIONS 1 AND 6 ON THE CURRENT ASSESSMENT ROLL

LEVEL OF ASSESSMENT (LOA)

_

II. SUMMARY OF TOTAL ASSESSED VALUES FOR ROLL SECTIONS 1, 3 AND 6 ON PRIOR ROLL AND CURRENT ROLL

PRIOR ROLL

CURRENT ROLL

UTILITY AND

UTILITY AND

TAXABLE

NON-CEILING

TAXABLE

NON-CEILING

STATE LAND

RAILROAD

STATE LAND

RAILROAD

ROLL

ROLL

ROLL

TOTAL ASSESSED

ROLL

ROLL

ROLL

TOTAL ASSESSED

SECTION 1

SECTION 3

SECTION 6

VALUE

SECTION 1

SECTION 3

SECTION 6

VALUE

A.

B.

C.

D.

E.

F.

G.

H.

1.

Village Total

2. Prior Roll Total Assessed Value

3. Difference

(Current Roll Minus Prior Roll)

(Subtract Line 2 from Line 1, Column H)

III. TOTAL ASSESSED VALUE OF RESIDENTIAL PROPERTY

4.

PRIOR ROLL

_______________

5.

CURRENT ROLL

_______________

IV. SUMMARY OF INCREASES AND DECREASES IN TOTAL ASSESSED VALUE OF ROLL SECTION 1, 3 AND 6 PROPERTIES

FROM PRIOR ROLL TO CURRENT ROLL AS DETAILED ON PART 2

6.

INCREASES Due to Quantity Changes (Total of Column K, Part 2)

_______________

7.

INCREASES for Equalization (Total of Column L, Part 2)

_______________

8.

Summary of Increases (Add Totals on Lines 6 and 7)

_______________

9.

DECREASES Due to Quantity Changes (Total of Column M, Part 2)

_______________

10.

DECREASES for Equalization (Total of Column N, Part 2)

_______________

11.

Summary of Decreases (Add Totals on Lines 9 and 10)

_______________

12.

Net Change in Total Assessed Value of Roll Section 1, 3 and 6

(Subtract Line 11 from Line 8)

_______________

13.

Difference in Change (Subtract Line 12 from Line 3)

_______________

The amount on Line 13 must equal zero for this report to balance.

If the amount on Line 13 is not zero, check computations

and see instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2