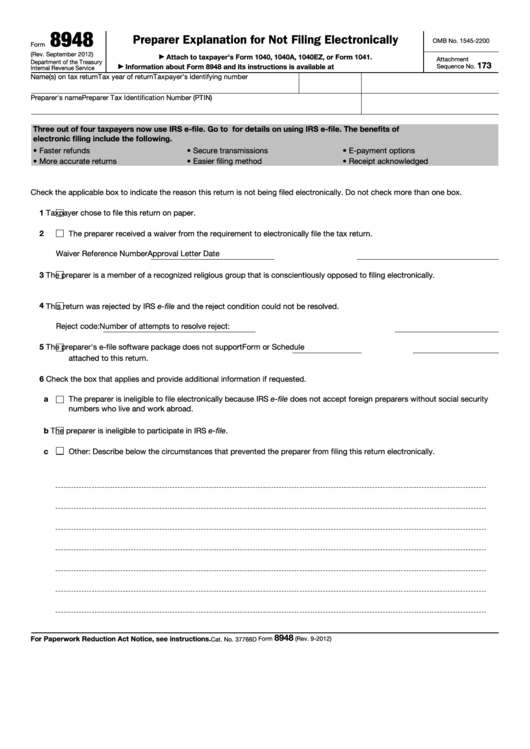

8948

Preparer Explanation for Not Filing Electronically

OMB No. 1545-2200

Form

(Rev. September 2012)

Attach to taxpayer's Form 1040, 1040A, 1040EZ, or Form 1041.

▶

Attachment

Department of the Treasury

173

Information about Form 8948 and its instructions is available at

Sequence No.

▶

Internal Revenue Service

Name(s) on tax return

Tax year of return

Taxpayer's identifying number

Preparer's name

Preparer Tax Identification Number (PTIN)

Three out of four taxpayers now use IRS e-file. Go to for details on using IRS e-file. The benefits of

electronic filing include the following.

• Faster refunds

• Secure transmissions

• E-payment options

• More accurate returns

• Easier filing method

• Receipt acknowledged

Check the applicable box to indicate the reason this return is not being filed electronically. Do not check more than one box.

1

Taxpayer chose to file this return on paper.

2

The preparer received a waiver from the requirement to electronically file the tax return.

Waiver Reference Number

Approval Letter Date

3

The preparer is a member of a recognized religious group that is conscientiously opposed to filing electronically.

4

This return was rejected by IRS e-file and the reject condition could not be resolved.

Reject code:

Number of attempts to resolve reject:

5

The preparer's e-file software package does not support Form

or Schedule

attached to this return.

6

Check the box that applies and provide additional information if requested.

a

The preparer is ineligible to file electronically because IRS e-file does not accept foreign preparers without social security

numbers who live and work abroad.

b

The preparer is ineligible to participate in IRS e-file.

c

Other: Describe below the circumstances that prevented the preparer from filing this return electronically.

8948

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 9-2012)

Cat. No. 37766D

1

1 2

2