2

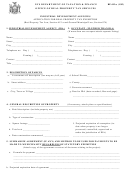

RP-412-a (1/95)

c. Municipal corporations to which payments will

d. Person or entity responsible for payment

be made

Yes No

Name ____________________________

County _____________________

Title ____________________________

Town/City ___________________

Village ______________________

Address __________________________

School District ________________

________________________________

e. Is the IDA the owner of the property?

Yes

No (check one)

If “No” identify owner and explain IDA rights or interest

Telephone ________________________

in an attached statement.

6. Is the property receiving or has the property ever received any other exemption from real property taxation?

(check one)

Yes

No

If yes, list the statutory exemption reference and assessment roll year on which granted:

exemption ___________________________ assessment roll year ____________________________

7. A copy of this application, including all attachments, has been mailed or delivered on ___________ (date)

to the chief executive official of each municipality within which the project is located as indicated in Item 3.

CERTIFICATION

I, ___________________________________________ , _________________________________ of

Name

Title

_____________________________________________________ hereby certify that the information

Organization

on this application and accompanying papers constitutes a true statement of facts.

_______________________

___________________________________

Date

Signature

Clear Form

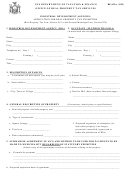

_____________________________________FOR USE BY ASSESSOR________________________________

1. Date application filed ___________________________________________

2. Applicable taxable status date ____________________________________

3a. Agreement (or extract) date _____________________________________

3b. Projected exemption expiration (year) _____________________________

4. Assessed valuation of parcel in first year of exemption $ _______________

5. Special assessments and special as valorem levies for which the parcel is liable:

_________________________________________________________________________________________

_________________________________________________________________________________________

_____________________

____________________________________

Date

Assessor’s signature

1

1 2

2