4

Form 1118 (Rev. 12-2015)

Page

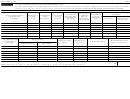

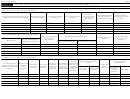

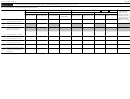

Schedule C

Tax Deemed Paid by Domestic Corporation Filing Return (Continued)

Part II—Dividends Paid Out of Pre-1987 Accumulated Profits

5. Foreign Taxes

8. Tax Deemed Paid

4. Accumulated

Paid and Deemed

6. Dividends Paid

(see instructions)

Profits for Tax Year

Paid on Earnings

1a. Name of Foreign

3. Country of

1c. Reference ID

2. Tax Year End

Indicated (in

and Profits

7. Divide column

1b. EIN (if any) of

Corporation (identify

Incorporation (enter

the foreign

number (see

(Yr-Mo) (see

functional currency

(E&P) for Tax Year

6(a) by

DISCs and former

country code - see

instructions)

instructions)

computed under

Indicated

column 4

corporation

DISCs)

instructions)

(a) Functional

(a) Functional

section 902) (attach

(in functional

(b) U.S. Dollars

(b) U.S. Dollars

Currency

Currency

schedule)

currency)

(see instructions)

Total (Add amounts in column 8b. Enter the result here and include on “Totals” line of Schedule B, Part I, column 3.)

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

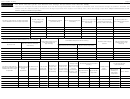

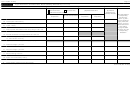

Part III—Deemed Inclusions From Pre-1987 Earnings and Profits

4. E&P for Tax Year

Indicated

6. Deemed Inclusions

3. Country of

(in functional

5. Foreign Taxes

1a. Name of Foreign

2. Tax Year

1b. EIN (if any) of

1c. Reference ID

Incorporation

currency

Paid and Deemed

7. Divide column

8. Tax Deemed Paid

Corporation (identify

End (Yr-Mo)

number (see

(enter country

translated from U.S.

Paid for

6(a) by

(multiply column 5

the foreign

DISCs and former

(see

corporation

instructions)

code - see

dollars,

Tax Year Indicated

column 4

by column 7)

DISCs)

instructions)

(a) Functional

instructions)

computed under

(see instructions)

(b) U.S. Dollars

Currency

section 964) (attach

schedule)

Total (Add amounts in column 8. Enter the result here and include on “Totals” line of Schedule B, Part I, column 3.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

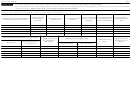

1118

Form

(Rev. 12-2015)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11