Clear Form

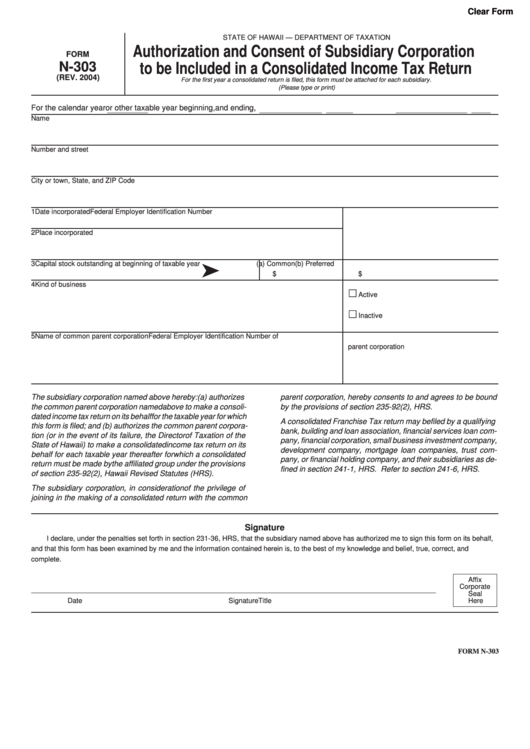

STATE OF HAWAII — DEPARTMENT OF TAXATION

Authorization and Consent of Subsidiary Corporation

FORM

N-303

to be Included in a Consolidated Income Tax Return

(REV. 2004)

For the first year a consolidated return is filed, this form must be attached for each subsidiary.

(Please type or print)

For the calendar year

or other taxable year beginning

,

and ending

,

Name

Number and street

City or town, State, and ZIP Code

1 Date incorporated

Federal Employer Identification Number

2 Place incorporated

ä

3 Capital stock outstanding at beginning of taxable year

(a) Common

(b) Preferred

$

$

4 Kind of business

£

Active

£

Inactive

5 Name of common parent corporation

Federal Employer Identification Number of

parent corporation

The subsidiary corporation named above hereby: (a) authorizes

parent corporation, hereby consents to and agrees to be bound

the common parent corporation named above to make a consoli-

by the provisions of section 235-92(2), HRS.

dated income tax return on its behalf for the taxable year for which

A consolidated Franchise Tax return may be filed by a qualifying

this form is filed; and (b) authorizes the common parent corpora-

bank, building and loan association, financial services loan com-

tion (or in the event of its failure, the Director of Taxation of the

pany, financial corporation, small business investment company,

State of Hawaii) to make a consolidated income tax return on its

development company, mortgage loan companies, trust com-

behalf for each taxable year thereafter for which a consolidated

pany, or financial holding company, and their subsidiaries as de-

return must be made by the affiliated group under the provisions

fined in section 241-1, HRS. Refer to section 241-6, HRS.

of section 235-92(2), Hawaii Revised Statutes (HRS).

The subsidiary corporation, in consideration of the privilege of

joining in the making of a consolidated return with the common

Signature

I declare, under the penalties set forth in section 231-36, HRS, that the subsidiary named above has authorized me to sign this form on its behalf,

and that this form has been examined by me and the information contained herein is, to the best of my knowledge and belief, true, correct, and

complete.

Affix

Corporate

Seal

Date

Signature

Title

Here

FORM N-303

1

1