Clear Form

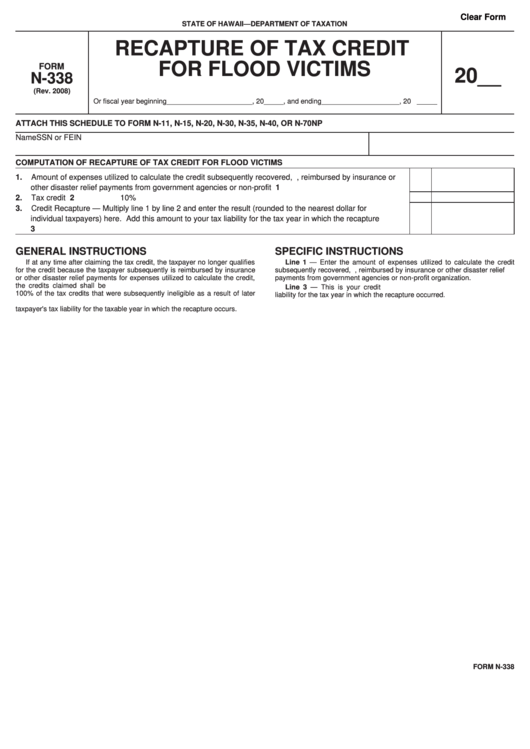

STATE OF HAWAII—DEPARTMENT OF TAXATION

RECAPTURE OF TAX CREDIT

FOR FLOOD VICTIMS

FORM

20__

N-338

(Rev. 2008)

Or fiscal year beginning ______________________, 20_____, and ending ____________________, 20

ATTACH THIS SCHEDULE TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP

Name

SSN or FEIN

COMPUTATION OF RECAPTURE OF TAX CREDIT FOR FLOOD VICTIMS

1.

Amount of expenses utilized to calculate the credit subsequently recovered, e.g., reimbursed by insurance or

other disaster relief payments from government agencies or non-profit organizations.......................................

1

2.

Tax credit percentage .......................................................................................................................................

2

10%

3.

Credit Recapture — Multiply line 1 by line 2 and enter the result (rounded to the nearest dollar for

individual taxpayers) here. Add this amount to your tax liability for the tax year in which the recapture

occurred .............................................................................................................................................................

3

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

If at any time after claiming the tax credit, the taxpayer no longer qualifies

Line 1 — Enter the amount of expenses utilized to calculate the credit

for the credit because the taxpayer subsequently is reimbursed by insurance

subsequently recovered, e.g., reimbursed by insurance or other disaster relief

or other disaster relief payments for expenses utilized to calculate the credit,

payments from government agencies or non-profit organization.

the credits claimed shall be recaptured. The recapture shall be equal to

Line 3 — This is your credit recapture. Add this amount to your tax

100% of the tax credits that were subsequently ineligible as a result of later

liability for the tax year in which the recapture occurred.

recovery. The amount of the recaptured tax credit shall be added to the

taxpayer's tax liability for the taxable year in which the recapture occurs.

FORM N-338

1

1