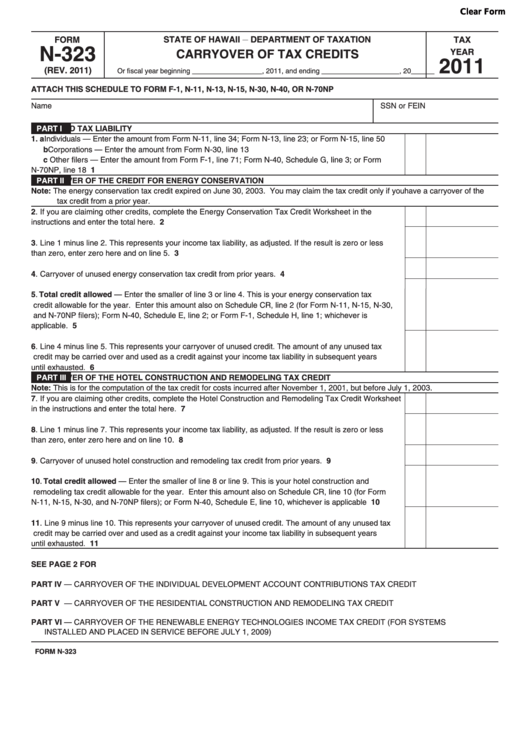

Clear Form

FORM

STATE OF HAWAII

DEPARTMENT OF TAXATION

TAX

__

N-323

YEAR

CARRYOVER OF TAX CREDITS

2011

(REV. 2011)

Or fiscal year beginning __________________, 2011, and ending ____________________, 20______

ATTACH THIS SCHEDULE TO FORM F-1, N-11, N-13, N-15, N-30, N-40, OR N-70NP

Name

SSN or FEIN

PART I

ADJUSTED TAX LIABILITY

1. a Individuals — Enter the amount from Form N-11, line 34; Form N-13, line 23; or Form N-15, line 50 .....

b Corporations — Enter the amount from Form N-30, line 13 .....................................................................

c Other filers — Enter the amount from Form F-1, line 71; Form N-40, Schedule G, line 3; or Form

1

N-70NP, line 18 .........................................................................................................................................

PART II

CARRYOVER OF THE CREDIT FOR ENERGY CONSERVATION

Note: The energy conservation tax credit expired on June 30, 2003. You may claim the tax credit only if you have a carryover of the

tax credit from a prior year.

2. If you are claiming other credits, complete the Energy Conservation Tax Credit Worksheet in the

instructions and enter the total here. ............................................................................................................

2

3. Line 1 minus line 2. This represents your income tax liability, as adjusted. If the result is zero or less

3

than zero, enter zero here and on line 5. .....................................................................................................

4. Carryover of unused energy conservation tax credit from prior years. .........................................................

4

5. Total credit allowed — Enter the smaller of line 3 or line 4. This is your energy conservation tax

credit allowable for the year. Enter this amount also on Schedule CR, line 2 (for Form N-11, N-15, N-30,

and N-70NP filers); Form N-40, Schedule E, line 2; or Form F-1, Schedule H, line 1; whichever is

applicable. ....................................................................................................................................................

5

6. Line 4 minus line 5. This represents your carryover of unused credit. The amount of any unused tax

credit may be carried over and used as a credit against your income tax liability in subsequent years

6

until exhausted. ............................................................................................................................................

PART III

CARRYOVER OF THE HOTEL CONSTRUCTION AND REMODELING TAX CREDIT

Note: This is for the computation of the tax credit for costs incurred after November 1, 2001, but before July 1, 2003.

7. If you are claiming other credits, complete the Hotel Construction and Remodeling Tax Credit Worksheet

in the instructions and enter the total here. ..................................................................................................

7

8. Line 1 minus line 7. This represents your income tax liability, as adjusted. If the result is zero or less

than zero, enter zero here and on line 10. ...................................................................................................

8

9. Carryover of unused hotel construction and remodeling tax credit from prior years. ...................................

9

10. Total credit allowed — Enter the smaller of line 8 or line 9. This is your hotel construction and

remodeling tax credit allowable for the year. Enter this amount also on Schedule CR, line 10 (for Form

N-11, N-15, N-30, and N-70NP filers); or Form N-40, Schedule E, line 10, whichever is applicable ...........

10

11. Line 9 minus line 10. This represents your carryover of unused credit. The amount of any unused tax

credit may be carried over and used as a credit against your income tax liability in subsequent years

until exhausted. ............................................................................................................................................

11

SEE PAGE 2 FOR

PART IV — CARRYOVER OF THE INDIVIDUAL DEVELOPMENT ACCOUNT CONTRIBUTIONS TAX CREDIT

PART V — CARRYOVER OF THE RESIDENTIAL CONSTRUCTION AND REMODELING TAX CREDIT

PART VI — CARRYOVER OF THE RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT (FOR SYSTEMS

INSTALLED AND PLACED IN SERVICE BEFORE JULY 1, 2009)

FORM N-323

1

1 2

2