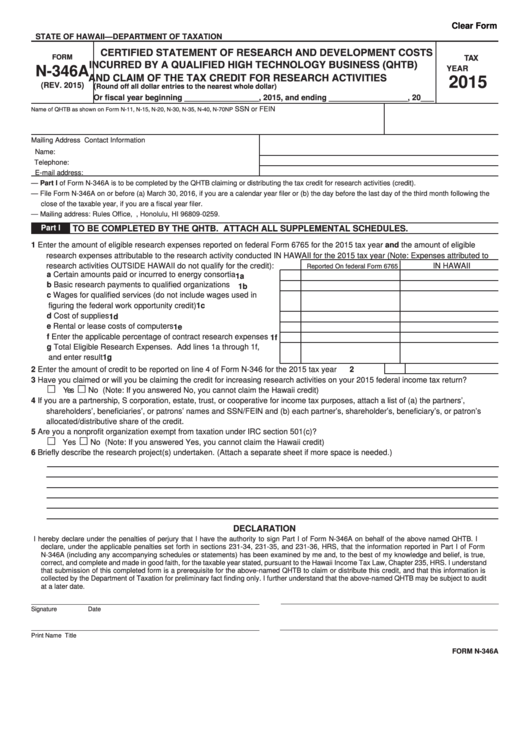

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

CERTIFIED STATEMENT OF RESEARCH AND DEVELOPMENT COSTS

FORM

TAX

INCURRED BY A QUALIFIED HIGH TECHNOLOGY BUSINESS (QHTB)

N-346A

YEAR

AND CLAIM OF THE TAX CREDIT FOR RESEARCH ACTIVITIES

2015

(REV. 2015)

(

Round off all dollar entries to the nearest whole dollar)

Or fiscal year beginning _________________, 2015, and ending __________________, 20___

Name of QHTB as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, N-70NP

SSN or FEIN

Mailing Address

Contact Information

Name:

Telephone:

E-mail address:

— Part I of Form N-346A is to be completed by the QHTB claiming or distributing the tax credit for research activities (credit).

— File Form N-346A on or before (a) March 30, 2016, if you are a calendar year filer or (b) the day before the last day of the third month following the

close of the taxable year, if you are a fiscal year filer.

— Mailing address: Rules Office, P.O. Box 259, Honolulu, HI 96809-0259.

Part I

TO BE COMPLETED BY THE QHTB. ATTACH ALL SUPPLEMENTAL SCHEDULES.

1

Enter the amount of eligible research expenses reported on federal Form 6765 for the 2015 tax year and the amount of eligible

research expenses attributable to the research activity conducted IN HAWAII for the 2015 tax year (Note: Expenses attributed to

Reported On federal Form 6765

research activities OUTSIDE HAWAII do not qualify for the credit):

IN HAWAII

a

Certain amounts paid or incurred to energy consortia. . . . . . .

1a

b

Basic research payments to qualified organizations

1b

. . . . . . . . . .

c

Wages for qualified services (do not include wages used in

1c

figuring the federal work opportunity credit) . . . . . . . . . . . . . . .

d

1d

Cost of supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e

1e

Rental or lease costs of computers . . . . . . . . . . . . . . . . . . . . .

f

1f

Enter the applicable percentage of contract research expenses

g

Total Eligible Research Expenses. Add lines 1a through 1f,

1g

and enter result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

Enter the amount of credit to be reported on line 4 of Form N-346 for the 2015 tax year . . . . . . . .

3

Have you claimed or will you be claiming the credit for increasing research activities on your 2015 federal income tax return?

Yes

No (Note: If you answered No, you cannot claim the Hawaii credit)

4

If you are a partnership, S corporation, estate, trust, or cooperative for income tax purposes, attach a list of (a) the partners’,

shareholders’, beneficiaries’, or patrons’ names and SSN/FEIN and (b) each partner’s, shareholder’s, beneficiary’s, or patron’s

allocated/distributive share of the credit.

5

Are you a nonprofit organization exempt from taxation under IRC section 501(c)?

Yes

No (Note: If you answered Yes, you cannot claim the Hawaii credit)

6

Briefly describe the research project(s) undertaken. (Attach a separate sheet if more space is needed.)

DECLARATION

I hereby declare under the penalties of perjury that I have the authority to sign Part I of Form N-346A on behalf of the above named QHTB. I

declare, under the applicable penalties set forth in sections 231-34, 231-35, and 231-36, HRS, that the information reported in Part I of Form

N-346A (including any accompanying schedules or statements) has been examined by me and, to the best of my knowledge and belief, is true,

correct, and complete and made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS. I understand

that submission of this completed form is a prerequisite for the above-named QHTB to claim or distribute this credit, and that this information is

collected by the Department of Taxation for preliminary fact finding only. I further understand that the above-named QHTB may be subject to audit

at a later date.

Signature

Date

Print Name

Title

FORM N-346A

1

1 2

2