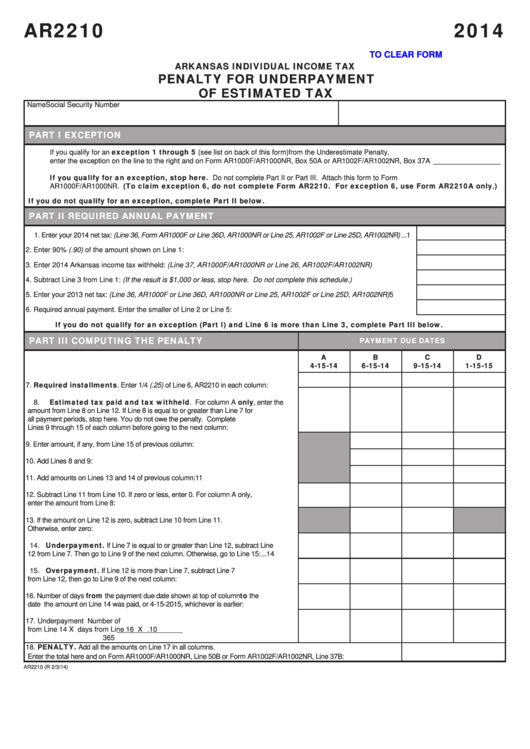

AR2210

2014

CLICK HERE TO CLEAR FORM

ARKANSAS INDIVIDUAL INCOME TAX

PENALTY FOR UNDERPAYMENT

OF ESTIMATED TAX

Name

Social Security Number

PART I

EXCEPTION

If you qualify for an exception 1 through 5 (see list on back of this form) from the Underestimate Penalty,

enter the exception on the line to the right and on Form AR1000F/AR1000NR, Box 50A or AR1002F/AR1002NR, Box 37A _________________

If you qualify for an exception, stop here. Do not complete Part II or Part III. Attach this form to Form

AR1000F/AR1000NR. (To claim exception 6, do not complete Form AR2210. For exception 6, use Form AR2210A only.)

If you do not qualify for an exception, complete Part II below.

PART II

REQUIRED ANNUAL PAYMENT

1.

Enter your 2014 net tax: (Line 36, Form AR1000F or Line 36D, AR1000NR or Line 25, AR1002F or Line 25D, AR1002NR) ... 1

2.

Enter 90% (.90) of the amount shown on Line 1: ............................................................................................................ 2

3.

Enter 2014 Arkansas income tax withheld: (Line 37, AR1000F/AR1000NR or Line 26, AR1002F/AR1002NR) ............ 3

4.

Subtract Line 3 from Line 1: (If the result is $1,000 or less, stop here. Do not complete this schedule.) ...................... 4

5.

Enter your 2013 net tax: (Line 36, AR1000F or Line 36D, AR1000NR or Line 25, AR1002F or Line 25D, AR1002NR) .....5

6.

Required annual payment. Enter the smaller of Line 2 or Line 5: ................................................................................... 6

If you do not qualify for an exception (Part I) and Line 6 is more than Line 3, complete Part III below.

PART III

COMPUTING THE PENALTY

PAYMENT DUE DATES

A

B

C

D

4-15-14

6-15-14

9-15-14

1-15-15

Required installments. Enter 1/4 (.25) of Line 6, AR2210 in each column: .... 7

7.

Estimated tax paid and tax withheld. For column A only, enter the

8.

amount from Line 8 on Line 12. If Line 8 is equal to or greater than Line 7 for

all payment periods, stop here. You do not owe the penalty. Complete

Lines 9 through 15 of each column before going to the next column: ..................... 8

9.

Enter amount, if any, from Line 15 of previous column: .......................................... 9

10.

Add Lines 8 and 9: ............................................................................................. 10

11.

Add amounts on Lines 13 and 14 of previous column:......................................... 11

12.

Subtract Line 11 from Line 10. If zero or less, enter 0. For column A only,

enter the amount from Line 8: ............................................................................ 12

13.

If the amount on Line 12 is zero, subtract Line 10 from Line 11.

Otherwise, enter zero: ........................................................................................ 13

Underpayment. If Line 7 is equal to or greater than Line 12, subtract Line

14.

12 from Line 7. Then go to Line 9 of the next column. Otherwise, go to Line 15: ... 14

Overpayment. If Line 12 is more than Line 7, subtract Line 7

15.

from Line 12, then go to Line 9 of the next column: ............................................. 15

Number of days from the payment due date shown at top of column to the

16.

date the amount on Line 14 was paid, or 4-15-2015, whichever is earlier: ........... 16

17.

Underpayment

Number of

from Line 14

X

days from Line 16

X

.10 ...................................... 17

365

PENALTY. Add all the amounts on Line 17 in all columns.

18.

Enter the total here and on Form AR1000F/AR1000NR, Line 50B or Form AR1002F/AR1002NR, Line 37B: ..............18

AR2210 (R 2/3/14)

1

1 2

2