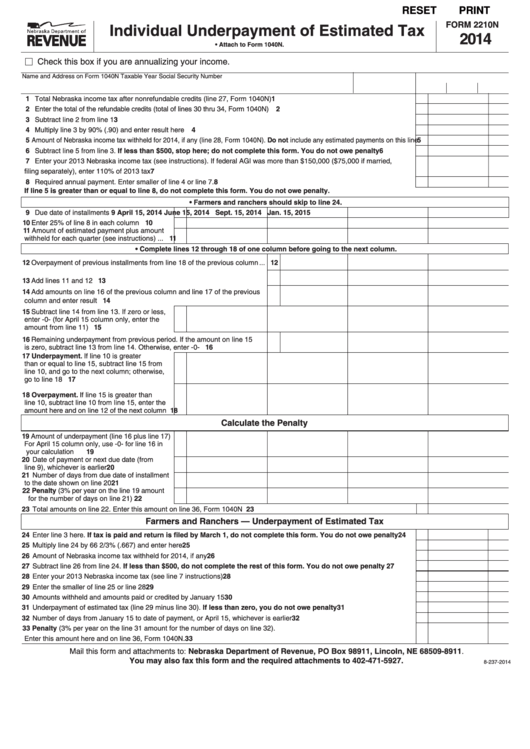

RESET

PRINT

FORM 2210N

Individual Underpayment of Estimated Tax

2014

• Attach to Form 1040N.

Check this box if you are annualizing your income.

Name and Address on Form 1040N

Taxable Year

Social Security Number

1 Total Nebraska income tax after nonrefundable credits (line 27, Form 1040N) ..............................................................................

1

2 Enter the total of the refundable credits (total of lines 30 thru 34, Form 1040N) ..............................................................................

2

3 Subtract line 2 from line 1 ..............................................................................................................................................................

3

4 Multiply line 3 by 90% (.90) and enter result here .........................................................................................................................

4

5 Amount of Nebraska income tax withheld for 2014, if any (line 28, Form 1040N). Do not include any estimated payments on this line

5

6 Subtract line 5 from line 3. If less than $500, stop here; do not complete this form. You do not owe penalty .......................

6

7 Enter your 2013 Nebraska income tax (see instructions). If federal AGI was more than $150,000 ($75,000 if married,

filing separately), enter 110% of 2013 tax ......................................................................................................................................

7

8 Required annual payment. Enter smaller of line 4 or line 7. ...........................................................................................................

8

If line 5 is greater than or equal to line 8, do not complete this form. You do not owe penalty.

• Farmers and ranchers should skip to line 24.

9 Due date of installments .................................

9

April 15, 2014

June 15, 2014

Sept. 15, 2014

Jan. 15, 2015

10 Enter 25% of line 8 in each column ................ 10

11 Amount of estimated payment plus amount

withheld for each quarter (see instructions) ... 11

• Complete lines 12 through 18 of one column before going to the next column.

12 Overpayment of previous installments from line 18 of the previous column ... 12

13 Add lines 11 and 12 ........................................................................................ 13

14 Add amounts on line 16 of the previous column and line 17 of the previous

column and enter result .................................................................................. 14

15 Subtract line 14 from line 13. If zero or less,

enter -0- (for April 15 column only, enter the

amount from line 11) ....................................... 15

16 Remaining underpayment from previous period. If the amount on line 15

is zero, subtract line 13 from line 14. Otherwise, enter -0- .............................. 16

17 Underpayment. If line 10 is greater

than or equal to line 15, subtract line 15 from

line 10, and go to the next column; otherwise,

go to line 18 .................................................... 17

18 Overpayment. If line 15 is greater than

line 10, subtract line 10 from line 15, enter the

amount here and on line 12 of the next column 18

Calculate the Penalty

19 Amount of underpayment (line 16 plus line 17)

For April 15 column only, use -0- for line 16 in

your calculation .............................................. 19

20 Date of payment or next due date (from

line 9), whichever is earlier ............................. 20

21 Number of days from due date of installment

to the date shown on line 20 ........................... 21

22 Penalty (3% per year on the line 19 amount

for the number of days on line 21) ............. 22

23 Total amounts on line 22. Enter this amount on line 36, Form 1040N ......................................................................................... 23

Farmers and Ranchers — Underpayment of Estimated Tax

24 Enter line 3 here. If tax is paid and return is filed by March 1, do not complete this form. You do not owe penalty ............ 24

25 Multiply line 24 by 66 2/3% (.667) and enter here ......................................................................................................................... 25

26 Amount of Nebraska income tax withheld for 2014, if any ............................................................................................................. 26

27 Subtract line 26 from line 24. If less than $500, do not complete the rest of this form. You do not owe penalty .................. 27

28 Enter your 2013 Nebraska income tax (see line 7 instructions) ..................................................................................................... 28

29 Enter the smaller of line 25 or line 28 ............................................................................................................................................ 29

30 Amounts withheld and amounts paid or credited by January 15 ................................................................................................... 30

31 Underpayment of estimated tax (line 29 minus line 30). If less than zero, you do not owe penalty .......................................... 31

32 Number of days from January 15 to date of payment, or April 15, whichever is earlier ................................................................. 32

33 Penalty (3% per year on the line 31 amount for the number of days on line 32).

Enter this amount here and on line 36, Form 1040N. .................................................................................................................... 33

Mail this form and attachments to: Nebraska Department of Revenue, PO Box 98911, Lincoln, NE 68509-8911.

You may also fax this form and the required attachments to 402-471-5927.

8-237-2014

1

1 2

2 3

3