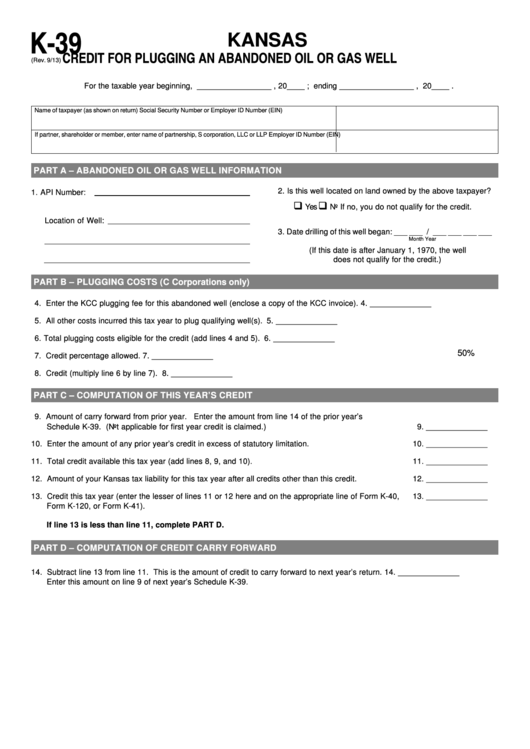

K-39

KANSAS

CREDIT FOR PLUGGING AN ABANDONED OIL OR GAS WELL

(Rev. 9/13)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – ABANDONED OIL OR GAS WELL INFORMATION

2.

Is this well located on land owned by the above taxpayer?

1. API Number:

‰

‰

Yes

No If no, you do not qualify for the credit.

Location of Well:

3.

Date drilling of this well began: ___ ___ / ___ ___ ___ ___

Month

Year

(If this date is after January 1, 1970, the well

does not qualify for the credit.)

PART B – PLUGGING COSTS (C Corporations only)

4. Enter the KCC plugging fee for this abandoned well (enclose a copy of the KCC invoice).

4.

______________

5. All other costs incurred this tax year to plug qualifying well(s).

5.

______________

6. Total plugging costs eligible for the credit (add lines 4 and 5).

6.

______________

50%

7. Credit percentage allowed.

7.

______________

8. Credit (multiply line 6 by line 7).

8.

______________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

9. Amount of carry forward from prior year. E nter the amount from line 14 of the prior year’s

Schedule K-39. (Not applicable for first year credit is claimed.)

9.

______________

10. Enter the amount of any prior year’s credit in excess of statutory limitation.

10.

______________

11. Total credit available this tax year (add lines 8, 9, and 10).

11.

______________

12. Amount of your Kansas tax liability for this tax year after all credits other than this credit.

12.

______________

13. Credit this tax year (enter the lesser of lines 11 or 12 here and on the appropriate line of Form K-40,

13.

______________

Form K-120, or Form K-41).

If line 13 is less than line 11, complete PART D.

PART D – COMPUTATION OF CREDIT CARRY FORWARD

14. Subtract line 13 from line 11. This is the amount of credit to carry forward to next year’s return.

14.

______________

Enter this amount on line 9 of next year’s Schedule K-39.

1

1 2

2