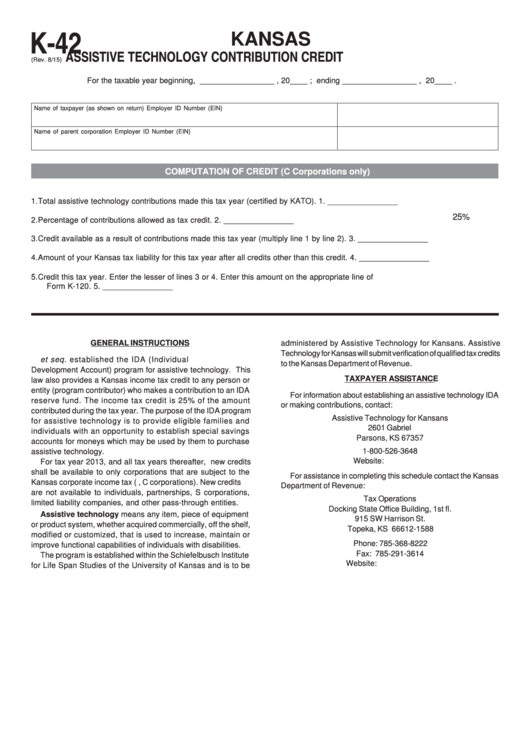

K-42

KANSAS

ASSISTIVE TECHNOLOGY CONTRIBUTION CREDIT

(Rev. 8/15)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Employer ID Number (EIN)

Name of parent corporation

Employer ID Number (EIN)

COMPUTATION OF CREDIT (C Corporations only)

1. Total assistive technology contributions made this tax year (certified by KATO).

1. ________________

25%

2. Percentage of contributions allowed as tax credit.

2. ________________

3. Credit available as a result of contributions made this tax year (multiply line 1 by line 2).

3. ________________

4. Amount of your Kansas tax liability for this tax year after all credits other than this credit.

4. ________________

5. Credit this tax year. Enter the lesser of lines 3 or 4. Enter this amount on the appropriate line of

Form K-120.

5. ________________

GENERAL INSTRUCTIONS

administered by Assistive Technology for Kansans. Assistive

Technology for Kansas will submit verification of qualified tax credits

K.S.A. 65-7101 et seq. established the IDA (Individual

to the Kansas Department of Revenue.

Development Account) program for assistive technology. This

TAXPAYER ASSISTANCE

law also provides a Kansas income tax credit to any person or

entity (program contributor) who makes a contribution to an IDA

For information about establishing an assistive technology IDA

reserve fund. The income tax credit is 25% of the amount

or making contributions, contact:

contributed during the tax year. The purpose of the IDA program

Assistive Technology for Kansans

for assistive technology is to provide eligible families and

2601 Gabriel

individuals with an opportunity to establish special savings

Parsons, KS 67357

accounts for moneys which may be used by them to purchase

1-800-526-3648

assistive technology.

Website: atk.ku.edu/

For tax year 2013, and all tax years thereafter, new credits

shall be available to only corporations that are subject to the

For assistance in completing this schedule contact the Kansas

Kansas corporate income tax (i.e., C corporations). New credits

Department of Revenue:

are not available to individuals, partnerships, S corporations,

Tax Operations

limited liability companies, and other pass-through entities.

Docking State Office Building, 1st fl.

Assistive technology means any item, piece of equipment

915 SW Harrison St.

or product system, whether acquired commercially, off the shelf,

Topeka, KS 66612-1588

modified or customized, that is used to increase, maintain or

Phone: 785-368-8222

improve functional capabilities of individuals with disabilities.

Fax: 785-291-3614

The program is established within the Schiefelbusch Institute

Website:

for Life Span Studies of the University of Kansas and is to be

1

1