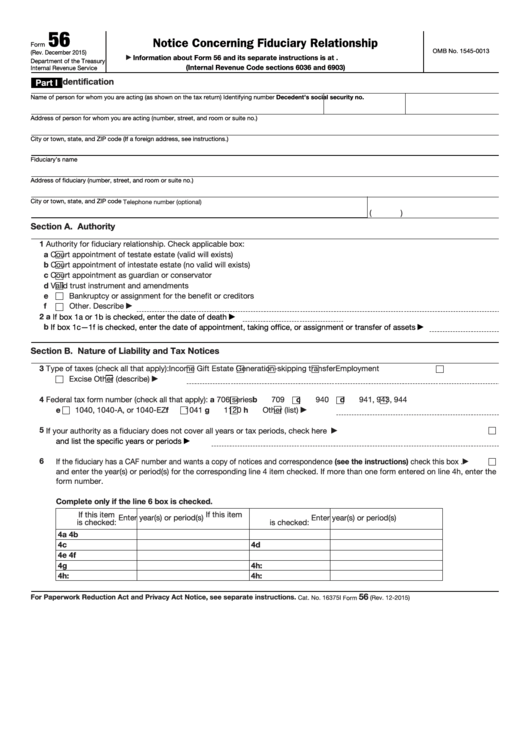

56

Notice Concerning Fiduciary Relationship

Form

OMB No. 1545-0013

(Rev. December 2015)

Information about Form 56 and its separate instructions is at

▶

Department of the Treasury

(Internal Revenue Code sections 6036 and 6903)

Internal Revenue Service

Identification

Part I

Name of person for whom you are acting (as shown on the tax return)

Identifying number

Decedent’s social security no.

Address of person for whom you are acting (number, street, and room or suite no.)

City or town, state, and ZIP code (If a foreign address, see instructions.)

Fiduciary’s name

Address of fiduciary (number, street, and room or suite no.)

City or town, state, and ZIP code

Telephone number (optional)

(

)

Section A. Authority

1

Authority for fiduciary relationship. Check applicable box:

a

Court appointment of testate estate (valid will exists)

b

Court appointment of intestate estate (no valid will exists)

c

Court appointment as guardian or conservator

d

Valid trust instrument and amendments

e

Bankruptcy or assignment for the benefit or creditors

f

Other. Describe

▶

2 a

If box 1a or 1b is checked, enter the date of death

▶

b

If box 1c—1f is checked, enter the date of appointment, taking office, or assignment or transfer of assets

▶

Section B. Nature of Liability and Tax Notices

3

Type of taxes (check all that apply):

Income

Gift

Estate

Generation-skipping transfer

Employment

Excise

Other (describe)

▶

4

Federal tax form number (check all that apply): a

706 series b

709

c

940

d

941, 943, 944

e

1040, 1040-A, or 1040-EZ

f

1041

g

1120 h

Other (list)

▶

5

If your authority as a fiduciary does not cover all years or tax periods, check here .

.

.

.

.

.

.

.

.

.

.

.

.

▶

and list the specific years or periods

▶

6

If the fiduciary has a CAF number and wants a copy of notices and correspondence (see the instructions) check this box

.

▶

and enter the year(s) or period(s) for the corresponding line 4 item checked. If more than one form entered on line 4h, enter the

form number.

Complete only if the line 6 box is checked.

If this item

If this item

Enter year(s) or period(s)

Enter year(s) or period(s)

is checked:

is checked:

4a

4b

4c

4d

4e

4f

4g

4h:

4h:

4h:

56

For Paperwork Reduction Act and Privacy Act Notice, see separate instructions.

Cat. No. 16375I

Form

(Rev. 12-2015)

1

1 2

2