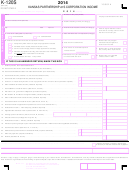

Instructions For Form K120s Example - Kansas Partnership Or S Corporation Income Tax Return Page 2

ADVERTISEMENT

Example for Individuals to figure lines 16 through 21 of K34 Credit

Sole proprietor, partner or shareholder percentage

Owned or per share basis:

35%

Allocated qualified business income:

$ 46,183.00

K-34 line 16

Times Percentage owned:

35%

Your share of qualified business facility income:

$ 16,164.05

The following two lines calculate your tax rate for the qualifying business income:

Your total Kansas tax liability:

$

2, 277.00

(line 8 or 12 which ever is applicable from K-40)

Divided by your taxable income:

$ 49,647.00

(line 7 from the K-40)

Effective tax rate:

4.5864%

Your share of qualified business facility income:

$ 16,164.05

Times effective tax rate:

4.5864%

Tax on qualified facility income:

$

741.00

50% of tax:

$

370.00

Total qualified employees and investment credit:

$

7,000.00

K-34 line 13

Times your percentage owned:

35%

Your share of credit:

$

2,450.00

Credit allowable:

$

370.00

K-34 line 21

(50% of tax or your share of credit, whichever is less

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2