Form 706me - Maine Estate Tax Return - 2015

ADVERTISEMENT

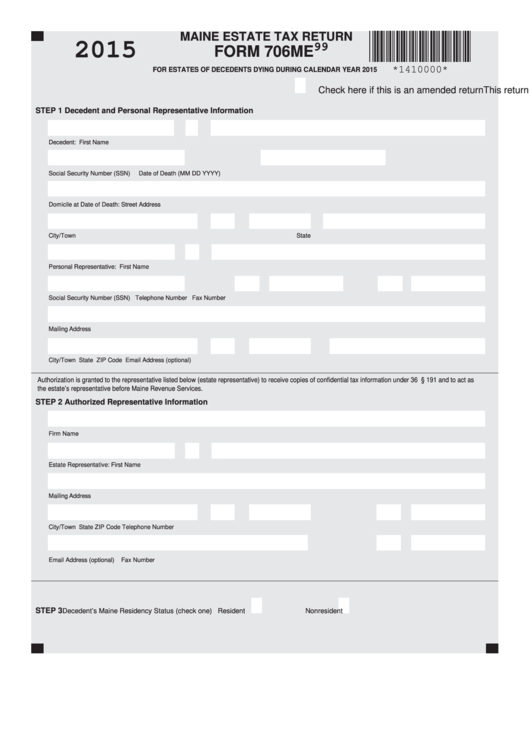

MAINE ESTATE TAX RETURN

2015

99

FORM 706ME

*1410000*

FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2015

This return is due nine months after the date of death.

Check here if this is an amended return

STEP 1 Decedent and Personal Representative Information

Decedent: First Name

M.I.

Last Name

Social Security Number (SSN)

Date of Death (MM DD YYYY)

Domicile at Date of Death: Street Address

City/Town

State

ZIP Code

County

Personal Representative: First Name

M.I.

Last Name

Social Security Number (SSN)

Telephone Number

Fax Number

Mailing Address

City/Town

State

ZIP Code

Email Address (optional)

Authorization is granted to the representative listed below (estate representative) to receive copies of confi dential tax information under 36 M.R.S. § 191 and to act as

the estate’s representative before Maine Revenue Services.

STEP 2 Authorized Representative Information

Firm Name

Estate Representative: First Name

M.I.

Last Name

Mailing Address

City/Town

State

ZIP Code

Telephone Number

Email Address (optional)

Fax Number

STEP 3

Decedent’s Maine Residency Status (check one)

Resident

Nonresident

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5