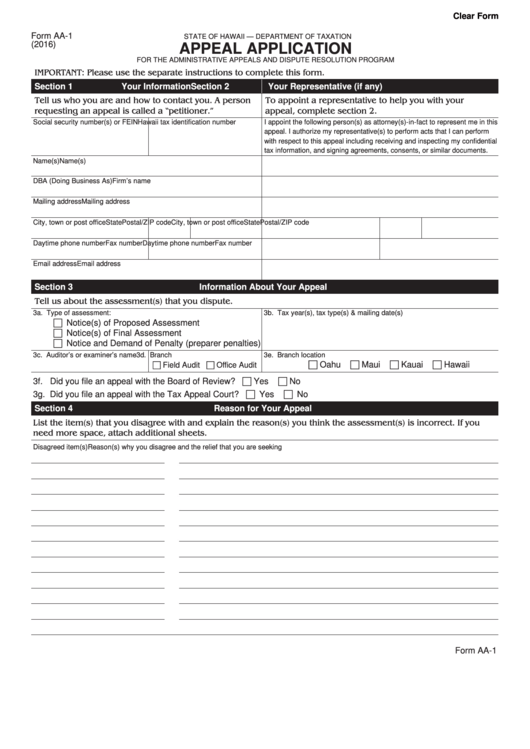

Clear Form

Form AA-1

STATE OF HAWAII — DEPARTMENT OF TAXATION

(2016)

APPEAL APPLICATION

FOR THE ADMINISTRATIVE APPEALS AND DISPUTE RESOLUTION PROGRAM

IMPORTANT: Please use the separate instructions to complete this form.

Section 1

Your Information

Section 2

Your Representative (if any)

Tell us who you are and how to contact you. A person

To appoint a representative to help you with your

requesting an appeal is called a “petitioner.”

appeal, complete section 2.

Social security number(s) or FEIN

Hawaii tax identification number

I appoint the following person(s) as attorney(s)-in-fact to represent me in this

appeal. I authorize my representative(s) to perform acts that I can perform

with respect to this appeal including receiving and inspecting my confidential

tax information, and signing agreements, consents, or similar documents.

Name(s)

Name(s)

DBA (Doing Business As)

Firm’s name

Mailing address

Mailing address

City, town or post office

State

Postal/ZIP code

City, town or post office

State

Postal/ZIP code

Daytime phone number

Fax number

Daytime phone number

Fax number

Email address

Email address

Section 3

Information About Your Appeal

Tell us about the assessment(s) that you dispute.

3a. Type of assessment:

3b. Tax year(s), tax type(s) & mailing date(s)

F Notice(s) of Proposed Assessment

F Notice(s) of Final Assessment

F Notice and Demand of Penalty (preparer penalties)

3c. Auditor’s or examiner’s name

3d. Branch

3e. Branch location

F Oahu

F Maui

F Kauai

F Hawaii

F Field Audit F Office Audit

3f. Did you file an appeal with the Board of Review? F Yes

F No

3g. Did you file an appeal with the Tax Appeal Court? F Yes

F No

Section 4

Reason for Your Appeal

List the item(s) that you disagree with and explain the reason(s) you think the assessment(s) is incorrect. If you

need more space, attach additional sheets.

Disagreed item(s)

Reason(s) why you disagree and the relief that you are seeking

Form AA-1

1

1 2

2