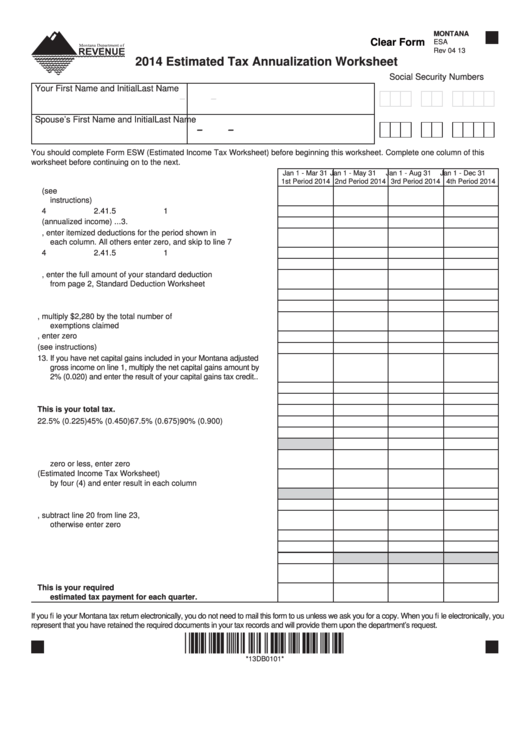

MONTANA

Clear Form

ESA

Rev 04 13

2014 Estimated Tax Annualization Worksheet

Social Security Numbers

Your First Name and Initial

Last Name

-

-

Spouse’s First Name and Initial

Last Name

-

-

You should complete Form ESW (Estimated Income Tax Worksheet) before beginning this worksheet. Complete one column of this

worksheet before continuing on to the next.

Jan 1 - Mar 31

Jan 1 - May 31

Jan 1 - Aug 31

Jan 1 - Dec 31

1st Period 2014

2nd Period 2014

3rd Period 2014

4th Period 2014

1. Enter your Montana adjusted gross income for each period (see

instructions) ................................................................................. 1.

2. Annualization amounts ................................................................ 2.

4

2.4

1.5

1

3. Multiply line 1 by line 2 and enter results (annualized income) ... 3.

4. If you itemize, enter itemized deductions for the period shown in

each column. All others enter zero, and skip to line 7 ................. 4.

5. Annualization amounts ................................................................ 5.

4

2.4

1.5

1

6. Multiply line 4 by line 5 ................................................................ 6.

7. In each column, enter the full amount of your standard deduction

from page 2, Standard Deduction Worksheet ............................. 7.

8. Enter larger of line 6 or line 7 ...................................................... 8.

9. Subtract line 8 from line 3 ............................................................ 9.

10. In each column, multiply $2,280 by the total number of

exemptions claimed ................................................................... 10.

11. Subtract line 10 from line 9. If zero or less, enter zero .............. 11.

12. Figure your tax on the amount on line 11 (see instructions) ...... 12.

13. If you have net capital gains included in your Montana adjusted

gross income on line 1, multiply the net capital gains amount by

2% (0.020) and enter the result of your capital gains tax credit.. ....13.

14. Subtract line 13 from line 12 ...................................................... 14.

15. Enter nonrefundable tax credits for each period........................ 15.

16. Subtract line 15 from line 14. This is your total tax. ................ 16.

17. Applicable percentage ............................................................... 17. 22.5% (0.225)

45% (0.450)

67.5% (0.675)

90% (0.900)

18. Multiply line 16 by line 17 .......................................................... 18.

19. Add amounts in all preceding columns of line 25 ...................... 19.

20. Annualized income installment. Subtract line 19 from line 18. If

zero or less, enter zero .............................................................. 20.

21. Divide line 9 of Form ESW (Estimated Income Tax Worksheet)

by four (4) and enter result in each column ............................... 21.

22. Enter amount from line 24 of preceding column ........................ 22.

23. Add lines 21 and 22 ................................................................... 23.

24. If line 23 is more than line 20, subtract line 20 from line 23,

otherwise enter zero .................................................................. 24.

25. Enter the smaller of either line 20 or line 23 .............................. 25.

26. Enter estimated 2014 withholding for each period .................... 26.

27. Enter the amount of your overpayments from the prior year ..... 27.

28. Enter the estimated amount of your refundable credits for each

period......................................................................................... 28.

29. Subtract lines 26 through 28 from line 25. This is your required

estimated tax payment for each quarter................................ 29.

If you fi le your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you fi le electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*13DB0101*

*13DB0101*

1

1 2

2