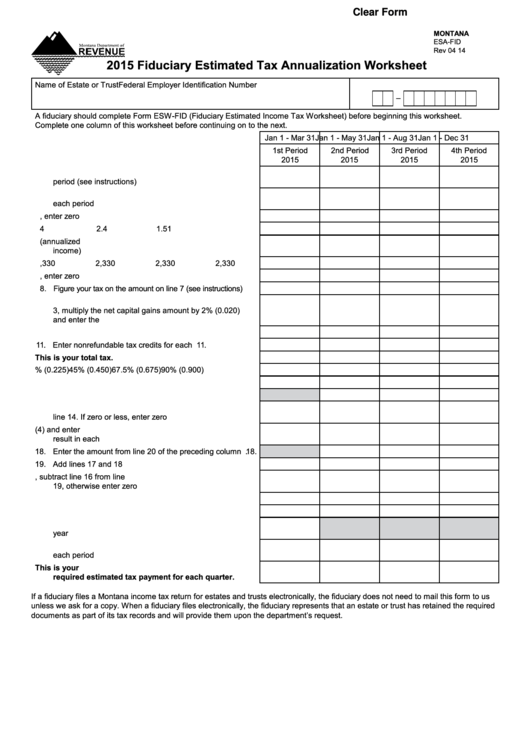

Clear Form

MONTANA

ESA-FID

Rev 04 14

2015 Fiduciary Estimated Tax Annualization Worksheet

Name of Estate or Trust

Federal Employer Identification Number

-

X X

X

X X X X X X

A fiduciary should complete Form ESW-FID (Fiduciary Estimated Income Tax Worksheet) before beginning this worksheet.

Complete one column of this worksheet before continuing on to the next.

Jan 1 - Mar 31

Jan 1 - May 31

Jan 1 - Aug 31

Jan 1 - Dec 31

1st Period

2nd Period

3rd Period

4th Period

2015

2015

2015

2015

1. Enter your Montana adjusted gross income for each

period (see instructions) ................................................... 1.

2. Enter the expected income distribution deduction for

each period ....................................................................... 2.

3. Subtract line 2 from line 1. If zero or less, enter zero ....... 3.

4. Annualization amounts ..................................................... 4.

4

2.4

1.5

1

5. Multiply line 3 by line 4 and enter results (annualized

income) ............................................................................. 5.

6. Exemption......................................................................... 6.

2,330

2,330

2,330

2,330

7. Subtract line 6 from line 5. If zero or less, enter zero ....... 7.

8. Figure your tax on the amount on line 7 (see instructions) .... 8.

9. If the estate/trust has net capital gains included on line

3, multiply the net capital gains amount by 2% (0.020)

and enter the result........................................................... 9.

10. Subtract line 9 from line 8 ............................................... 10.

11. Enter nonrefundable tax credits for each period............. 11.

12. Subtract line 11 from line 10. This is your total tax. ..... 12.

13. Applicable percentage .................................................... 13.

22.5% (0.225)

45% (0.450)

67.5% (0.675) 90% (0.900)

14. Multiply line 12 by line 13 ............................................... 14.

15. Add amounts in all preceding columns of line 21 ........... 15.

16. Annualized income installment. Subtract line 15 from

line 14. If zero or less, enter zero ................................... 16.

17. Divide line 9 of Form ESW-FID by four (4) and enter

result in each column...................................................... 17.

18. Enter the amount from line 20 of the preceding column .. 18.

19. Add lines 17 and 18 ........................................................ 19.

20. If line 19 is more than line 16, subtract line 16 from line

19, otherwise enter zero ................................................. 20.

21. Enter the smaller of either line 16 or line 19 ................... 21.

22. Enter estimated 2015 withholding for each period ......... 22.

23. Enter the amount of your overpayments from the prior

year................................................................................. 23.

24. Enter the estimated amount of refundable credits for

each period ..................................................................... 24.

25. Subtract lines 22 through 24 from line 21. This is your

required estimated tax payment for each quarter. .... 25.

If a fiduciary files a Montana income tax return for estates and trusts electronically, the fiduciary does not need to mail this form to us

unless we ask for a copy. When a fiduciary files electronically, the fiduciary represents that an estate or trust has retained the required

documents as part of its tax records and will provide them upon the department’s request.

1

1 2

2