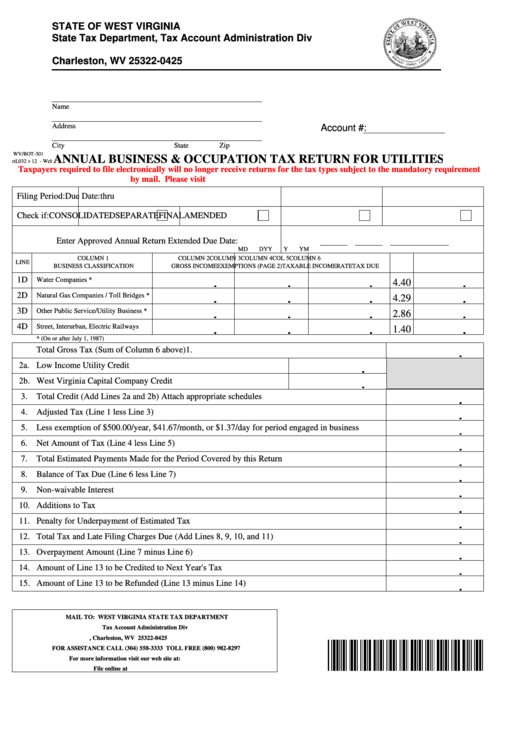

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

WV/BOT-301

ANNUAL BUSINESS & OCCUPATION TAX RETURN FOR UTILITIES

rtL032 v 12 - Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement

by mail. Please visit for additional information.

Filing Period:

thru

Due Date:

Check if:

CONSOLIDATED

SEPARATE

FINAL

AMENDED

Enter Approved Annual Return Extended Due Date:

M

M

D

D

Y

Y

Y

Y

COLUMN 1

COLUMN 2

COLUMN 3

COLUMN 4

COL 5

COLUMN 6

LINE

BUSINESS CLASSIFICATION

GROSS INCOME

EXEMPTIONS (PAGE 2)

TAXABLE INCOME

RATE

TAX DUE

1D

Water Companies *

.

.

.

4.40

.

2D

Natural Gas Companies / Toll Bridges *

.

.

.

4.29

.

3D

Other Public Service/Utility Business *

.

.

.

2.86

.

4D

Street, Interurban, Electric Railways

.

.

.

1.40

.

* (On or after July 1, 1987)

1.

Total Gross Tax (Sum of Column 6 above)

.

2a.

Low Income Utility Credit

.

2b.

West Virginia Capital Company Credit

.

3.

Total Credit (Add Lines 2a and 2b) Attach appropriate schedules

.

4.

Adjusted Tax (Line 1 less Line 3)

.

5.

Less exemption of $500.00/year, $41.67/month, or $1.37/day for period engaged in business

.

6.

Net Amount of Tax (Line 4 less Line 5)

.

7.

Total Estimated Payments Made for the Period Covered by this Return

.

8.

Balance of Tax Due (Line 6 less Line 7)

.

9.

Non-waivable Interest

.

10.

Additions to Tax

.

11.

Penalty for Underpayment of Estimated Tax

.

12.

Total Tax and Late Filing Charges Due (Add Lines 8, 9, 10, and 11)

.

13.

Overpayment Amount (Line 7 minus Line 6)

.

14.

Amount of Line 13 to be Credited to Next Year's Tax

.

15.

Amount of Line 13 to be Refunded (Line 13 minus Line 14)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

File online at https://mytaxes.wvtax.gov

1

1 2

2