2

Schedule N (Form 990 or 990-EZ) (2015)

Page

Part I

Liquidation, Termination, or Dissolution (continued)

Note. If the organization distributed all of its assets during the tax year, then Form 990, Part X, column (B), line 16 (Total assets), and line 26

Yes No

(Total liabilities), should equal -0-.

3

Did the organization distribute its assets in accordance with its governing instrument(s)? If “No,” describe in Part III .

.

.

.

.

.

.

.

.

.

.

.

.

3

4a Is the organization required to notify the attorney general or other appropriate state official of its intent to dissolve, liquidate, or terminate? .

.

.

.

.

4a

b If “Yes,” did the organization provide such notice?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4b

5

Did the organization discharge or pay all of its liabilities in accordance with state laws? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6a Did the organization have any tax-exempt bonds outstanding during the year? .

6a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b If “Yes” to line 6a, did the organization discharge or defease all of its tax-exempt bond liabilities during the tax year in accordance with the Internal Revenue Code and state laws?

6b

c If “Yes” on line 6b, describe in Part III how the organization defeased or otherwise settled these liabilities. If “No” on line 6b, explain in Part III.

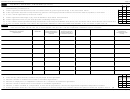

Part II

Sale, Exchange, Disposition, or Other Transfer of More Than 25% of the Organization’s Assets. Complete this part if the organization answered

“Yes” on Form 990, Part IV, line 32, or Form 990-EZ, line 36. Part II can be duplicated if additional space is needed.

1

(a) Description of asset(s)

(b) Date of

(c) Fair market value of

(d) Method of

(e) EIN of recipient

(f) Name and address of recipient

(g) IRC section of

distributed or transaction

distribution

asset(s) distributed or

determining FMV for

recipient(s) (if

expenses paid

amount of transaction

asset(s) distributed or

tax-exempt) or type

expenses

transaction expenses

of entity

Yes No

2

Did or will any officer, director, trustee, or key employee of the organization:

a Become a director or trustee of a successor or transferee organization? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a

b Become an employee of, or independent contractor for, a successor or transferee organization? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b

c Become a direct or indirect owner of a successor or transferee organization?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2c

d Receive, or become entitled to, compensation or other similar payments as a result of the organization’s significant disposition of assets? .

2d

.

.

.

.

e If the organization answered “Yes” to any of the questions on lines 2a through 2d, provide the name of the person involved and explain in Part III .

▶

Schedule N (Form 990 or 990-EZ) (2015)

1

1 2

2 3

3 4

4 5

5