5

Schedule N (Form 990 or 990-EZ) (2015)

Page

Line 6c. If the organization checked “Yes” on

2. One of a series of related dispositions or

• Asset sales made in the ordinary course of

line 6b, explain in Part III how the bond

events commenced in a prior year, that, when

the organization's exempt activities to

liabilities were discharged, defeased, or

combined, comprise more than 25 percent of

accomplish the organization's exempt

otherwise settled during the year. Also

the FMV of the organization’s net assets as of

purposes; for instance, gross sales of

provide an explanation if any bond liabilities

the beginning of the tax year when the first

inventory.

were discharged, defeased, or otherwise

disposition in the series was made. Whether a

• Grants or other assistance made in the

settled other than in accordance with the

significant disposition occurred through a

ordinary course of the organization's exempt

Code or applicable state law, or if the

series of related dispositions or events

activities to accomplish the organization's

organization did not discharge or defease any

depends on the facts and circumstances in

exempt purposes; for instance, the regular

of its bond liabilities. If the organization

each case.

charitable distributions of a United Way or

avoided the need for a defeasance of bonds,

A significant disposition of net assets may

other federated fundraising organization.

such as through the transfer of assets to

result from either an expansion or a

• A decrease in the value of net assets due to

another section 501(c)(3) organization, provide

contraction of operations. Examples of the

market fluctuation in the value of assets held

the name of the transferees of such assets,

types of transactions required to be reported

by the organization.

the CUSIP number of the bond issue, and a

in Part II as significant dispositions of net

description of the terms of such arrangements

• Transfers to a disregarded entity of which

assets include the following:

in Part III.

the organization is the sole member.

• Taxable or tax-free sales or exchanges of

An organization that completes

For purposes of Schedule N, “net assets”

exempt assets for cash or other consideration

Part I does not complete Part II.

means total assets less total liabilities. The

TIP

(such as a social club described in section

determination of a significant disposition of

501(c)(7) selling land or assets it had used to

net assets is made by reference to the FMV of

further its exempt purposes).

the organization’s net assets at the beginning

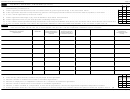

Part II. Sale, Exchange,

• Sales, contributions, or other transfers of

of the tax year (in the case of a series of

assets to establish or maintain a partnership,

Disposition, or Other Transfer of

related dispositions that commenced in a

joint venture, or a corporation (for-profit or

More Than 25 Percent of the

prior year, at the beginning of the tax year

nonprofit) regardless of whether such sales or

during which the first disposition was made).

Organization’s Assets

transfers are governed by section 721 or

Line 1. Refer to the instructions for Part I, line

section 351, and whether or not the transferor

If an organization answered “Yes” to Form

1, columns (a)–(g), earlier.

receives an ownership interest in exchange

990, Part IV, line 32 or Form 990-EZ, line 36,

for the transfer.

If there are more transactions to report in

because it made a significant disposition of

Part II than space available, Part II can be

net assets during the tax year, it must

• Sales of assets by a partnership or joint

duplicated to report the additional

complete Part II. A significant disposition of

venture in which the organization has an

transactions.

the organization’s net assets includes a sale,

ownership interest.

exchange, disposition, or other transfer of

Line 2. Refer to the instructions for Part I, line

• Transfers of assets pursuant to a

more than 25 percent of the FMV of its net

2, earlier.

reorganization in which the organization is a

assets during the tax year, regardless of

surviving entity.

Part III. Supplemental Information

whether the organization received full and

The following types of situations are not

adequate consideration. A significant

Use Part III to provide the narrative

required to be reported in Part II:

disposition of net assets involves:

information required in Part I, lines 2e, 3, and

• The change in composition of publicly

1. One or more dispositions during the

6c, and Part II, line 2e. Also use Part III to

traded securities held in an exempt

organization’s tax year amounting to more

provide additional narrative explanations and

organization’s passive investment portfolio.

than 25 percent of the FMV of the

descriptions as necessary to support or

organization’s net assets as of the beginning

supplement any responses in Part I or II.

of its tax year; or

Identify the specific part and line(s) that the

response supports. Part III may be duplicated

if more space is needed.

1

1 2

2 3

3 4

4 5

5