No

Staples

S

Clear Form

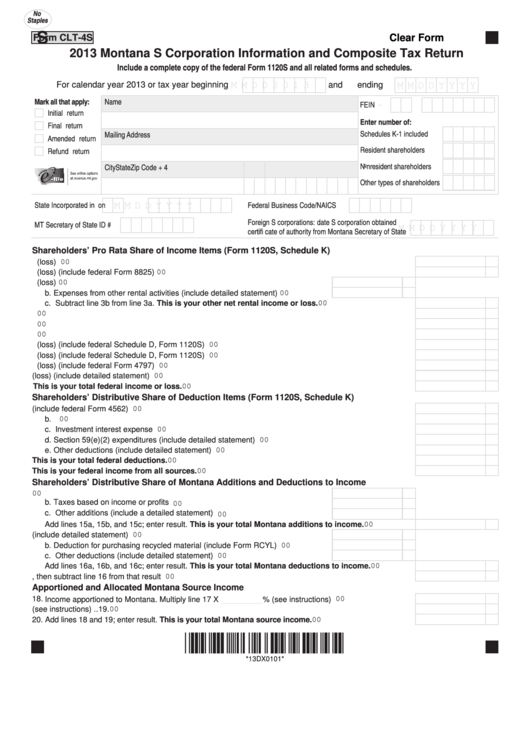

Form CLT-4S

2013 Montana S Corporation Information and Composite Tax Return

Include a complete copy of the federal Form 1120S and all related forms and schedules.

For calendar year 2013 or tax year beginning

M M D D 2 0 1 3

and ending

M M D D Y Y Y Y

Mark all that apply:

Name

FEIN

-

Initial return

Enter number of:

Final return

Schedules K-1 included

Mailing Address

Amended return

Resident shareholders

Refund return

Nonresident shareholders

City

State Zip Code + 4

Other types of shareholders

State Incorporated in

on

Federal Business Code/NAICS

M M D D Y Y Y Y

Foreign S corporations: date S corporation obtained

MT Secretary of State ID #

M M D D Y Y Y Y

certifi cate of authority from Montana Secretary of State

Shareholders’ Pro Rata Share of Income Items (Form 1120S, Schedule K)

1. Ordinary business income (loss) ................................................................................................................... 1.

00

2. Net rental real estate income (loss) (include federal Form 8825).................................................................. 2.

00

3. a. Other gross rental income (loss)....................................................................... 3a.

00

b. Expenses from other rental activities (include detailed statement)................... 3b.

00

c. Subtract line 3b from line 3a. This is your other net rental income or loss. ......................................3c.

00

4. Interest income .............................................................................................................................................. 4.

00

5. Ordinary dividends......................................................................................................................................... 5.

00

6. Royalties ........................................................................................................................................................ 6.

00

7. Net short-term capital gain (loss) (include federal Schedule D, Form 1120S) ............................................... 7.

00

8. Net long-term capital gain (loss) (include federal Schedule D, Form 1120S) ................................................ 8.

00

9. Net section 1231 gain (loss) (include federal Form 4797) ............................................................................. 9.

00

10. Other income (loss) (include detailed statement) ........................................................................................ 10.

00

11. Add lines 1 through 10 and enter result. This is your total federal income or loss. ................................11.

00

Shareholders’ Distributive Share of Deduction Items (Form 1120S, Schedule K)

12. a. Section 179 deduction (include federal Form 4562) ............................................................................. 12a.

00

b. Contributions......................................................................................................................................... 12b.

00

c. Investment interest expense ..................................................................................................................12c.

00

d. Section 59(e)(2) expenditures (include detailed statement) ................................................................. 12d.

00

e. Other deductions (include detailed statement) ..................................................................................... 12e.

00

13. Add lines 12a through 12e and enter result. This is your total federal deductions. ............................... 13.

00

14. Subtract line 13 from line 11. This is your federal income from all sources. .......................................... 14.

00

Shareholders’ Distributive Share of Montana Additions and Deductions to Income

15. a. Interest and dividends not taxable under the Internal Revenue Code ............ 15a.

00

b. Taxes based on income or profi ts ................................................................... 15b.

00

c. Other additions (include a detailed statement) ............................................... 15c.

00

Add lines 15a, 15b, and 15c; enter result. This is your total Montana additions to income. ................. 15.

00

16. a. Interest on U.S. government obligations (include detailed statement) ........... 16a.

00

b. Deduction for purchasing recycled material (include Form RCYL) ................. 16b.

00

c. Other deductions (include detailed statement) ............................................... 16c.

00

Add lines 16a, 16b, and 16c; enter result. This is your total Montana deductions to income. .............. 16.

00

17. Add lines 14 and 15, then subtract line 16 from that result ......................................................................... 17.

00

Apportioned and Allocated Montana Source Income

________

18. Income apportioned to Montana. Multiply line 17 X

00

% (see instructions) ............................... 18.

19. Income allocated to Montana. Enter the income or loss allocated directly to Montana (see instructions) .. 19.

00

20. Add lines 18 and 19; enter result. This is your total Montana source income. ......................................... 20.

00

*13DX0101*

*13DX0101*

1

1 2

2 3

3 4

4 5

5 6

6 7

7