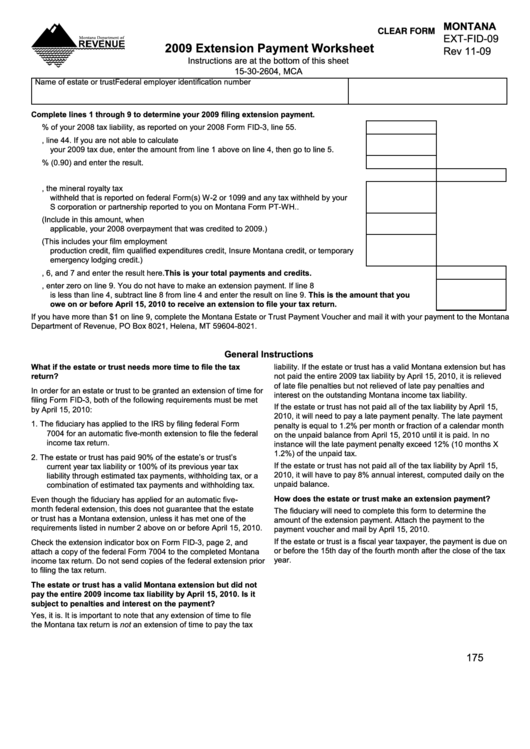

Montana

CLEAR FORM

EXT-FID-09

2009 Extension Payment Worksheet

Rev 11-09

Instructions are at the bottom of this sheet

15-30-2604, MCA

Name of estate or trust

Federal employer identification number

Complete lines 1 through 9 to determine your 2009 filing extension payment.

1. Enter 100% of your 2008 tax liability, as reported on your 2008 Form FID-3, line 55. .........1.

2. Enter your total tax due from your 2009 Form FID-3, line 44. If you are not able to calculate

your 2009 tax due, enter the amount from line 1 above on line 4, then go to line 5. ............2.

3. Multiply line 2 by 90% (0.90) and enter the result. ...............................................................3.

4. Enter the smaller of line 1 or line 3 here. .............................................................................................................. 4.

5. Enter the amount of your 2009 Montana income tax withheld, the mineral royalty tax

withheld that is reported on federal Form(s) W-2 or 1099 and any tax withheld by your

S corporation or partnership reported to you on Montana Form PT-WH.. ............................5.

6. Enter the amount of your 2009 estimated tax payments. (Include in this amount, when

applicable, your 2008 overpayment that was credited to 2009.) ..........................................6.

7. Enter the amount of your 2009 refundable credits. (This includes your film employment

production credit, film qualified expenditures credit, Insure Montana credit, or temporary

emergency lodging credit.) ...................................................................................................7.

8. Add lines 5, 6, and 7 and enter the result here. this is your total payments and credits. ............................... 8.

9. If line 8 is greater than line 4, enter zero on line 9. You do not have to make an extension payment. If line 8

is less than line 4, subtract line 8 from line 4 and enter the result on line 9. this is the amount that you

owe on or before april 15, 2010 to receive an extension to file your tax return. .......................................... 9.

If you have more than $1 on line 9, complete the Montana Estate or Trust Payment Voucher and mail it with your payment to the Montana

Department of Revenue, PO Box 8021, Helena, MT 59604-8021.

General Instructions

What if the estate or trust needs more time to file the tax

liability. If the estate or trust has a valid Montana extension but has

return?

not paid the entire 2009 tax liability by April 15, 2010, it is relieved

of late file penalties but not relieved of late pay penalties and

In order for an estate or trust to be granted an extension of time for

interest on the outstanding Montana income tax liability.

filing Form FID-3, both of the following requirements must be met

If the estate or trust has not paid all of the tax liability by April 15,

by April 15, 2010:

2010, it will need to pay a late payment penalty. The late payment

1.

The fiduciary has applied to the IRS by filing federal Form

penalty is equal to 1.2% per month or fraction of a calendar month

7004 for an automatic five-month extension to file the federal

on the unpaid balance from April 15, 2010 until it is paid. In no

income tax return.

instance will the late payment penalty exceed 12% (10 months X

1.2%) of the unpaid tax.

2.

The estate or trust has paid 90% of the estate’s or trust’s

If the estate or trust has not paid all of the tax liability by April 15,

current year tax liability or 100% of its previous year tax

2010, it will have to pay 8% annual interest, computed daily on the

liability through estimated tax payments, withholding tax, or a

unpaid balance.

combination of estimated tax payments and withholding tax.

How does the estate or trust make an extension payment?

Even though the fiduciary has applied for an automatic five-

month federal extension, this does not guarantee that the estate

The fiduciary will need to complete this form to determine the

or trust has a Montana extension, unless it has met one of the

amount of the extension payment. Attach the payment to the

requirements listed in number 2 above on or before April 15, 2010.

payment voucher and mail by April 15, 2010.

If the estate or trust is a fiscal year taxpayer, the payment is due on

Check the extension indicator box on Form FID-3, page 2, and

or before the 15th day of the fourth month after the close of the tax

attach a copy of the federal Form 7004 to the completed Montana

year.

income tax return. Do not send copies of the federal extension prior

to filing the tax return.

the estate or trust has a valid Montana extension but did not

pay the entire 2009 income tax liability by april 15, 2010. Is it

subject to penalties and interest on the payment?

Yes, it is. It is important to note that any extension of time to file

the Montana tax return is not an extension of time to pay the tax

175

1

1 2

2