Montana

Clear Form

EXT-09

2009 Extension Payment Worksheet

Rev. 11-09

Instructions are at the bottom of this sheet

15-30-2604, MCA

Your first name and middle initial

Last name

Your social security number

Spouse's first name and initial

Last name

Social security number

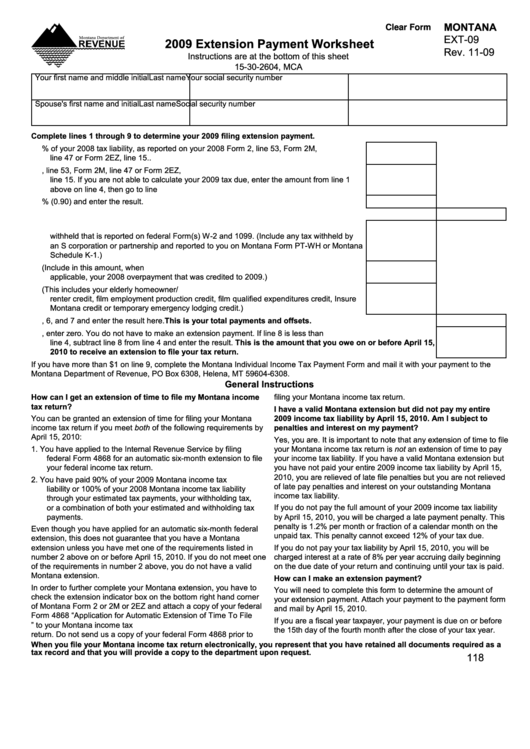

Complete lines 1 through 9 to determine your 2009 filing extension payment.

1. Enter 100% of your 2008 tax liability, as reported on your 2008 Form 2, line 53, Form 2M,

line 47 or Form 2EZ, line 15.. ...............................................................................................1.

2. Enter your total tax due from your 2009 Form 2, line 53, Form 2M, line 47 or Form 2EZ,

line 15. If you are not able to calculate your 2009 tax due, enter the amount from line 1

above on line 4, then go to line 5..........................................................................................2.

3. Multiply line 2 by 90% (0.90) and enter the result. ...............................................................3.

4. Enter the smaller of line 1 or line 3 here. .............................................................................................................. 4.

5. Enter the amount of your 2009 Montana income tax withheld and the mineral royalty tax

withheld that is reported on federal Form(s) W-2 and 1099. (Include any tax withheld by

an S corporation or partnership and reported to you on Montana Form PT-WH or Montana

Schedule K-1.) ......................................................................................................................5.

6. Enter the amount of your 2009 estimated tax payments. (Include in this amount, when

applicable, your 2008 overpayment that was credited to 2009.) ..........................................6.

7. Enter the amount of your 2009 refundable credits. (This includes your elderly homeowner/

renter credit, film employment production credit, film qualified expenditures credit, Insure

Montana credit or temporary emergency lodging credit.) .....................................................7.

8. Add lines 5, 6, and 7 and enter the result here. this is your total payments and offsets. ............................... 8.

9. If line 8 is greater than line 4, enter zero. You do not have to make an extension payment. If line 8 is less than

line 4, subtract line 8 from line 4 and enter the result. this is the amount that you owe on or before april 15,

2010 to receive an extension to file your tax return. ....................................................................................... 9.

If you have more than $1 on line 9, complete the Montana Individual Income Tax Payment Form and mail it with your payment to the

Montana Department of Revenue, PO Box 6308, Helena, MT 59604-6308.

General Instructions

How can I get an extension of time to file my Montana income

filing your Montana income tax return.

tax return?

I have a valid Montana extension but did not pay my entire

You can be granted an extension of time for filing your Montana

2009 income tax liability by april 15, 2010. am I subject to

income tax return if you meet both of the following requirements by

penalties and interest on my payment?

April 15, 2010:

Yes, you are. It is important to note that any extension of time to file

1.

You have applied to the Internal Revenue Service by filing

your Montana income tax return is not an extension of time to pay

federal Form 4868 for an automatic six-month extension to file

your income tax liability. If you have a valid Montana extension but

your federal income tax return.

you have not paid your entire 2009 income tax liability by April 15,

2010, you are relieved of late file penalties but you are not relieved

2.

You have paid 90% of your 2009 Montana income tax

of late pay penalties and interest on your outstanding Montana

liability or 100% of your 2008 Montana income tax liability

income tax liability.

through your estimated tax payments, your withholding tax,

or a combination of both your estimated and withholding tax

If you do not pay the full amount of your 2009 income tax liability

payments.

by April 15, 2010, you will be charged a late payment penalty. This

penalty is 1.2% per month or fraction of a calendar month on the

Even though you have applied for an automatic six-month federal

unpaid tax. This penalty cannot exceed 12% of your tax due.

extension, this does not guarantee that you have a Montana

extension unless you have met one of the requirements listed in

If you do not pay your tax liability by April 15, 2010, you will be

number 2 above on or before April 15, 2010. If you do not meet one

charged interest at a rate of 8% per year accruing daily beginning

of the requirements in number 2 above, you do not have a valid

on the due date of your return and continuing until your tax is paid.

Montana extension.

How can I make an extension payment?

In order to further complete your Montana extension, you have to

You will need to complete this form to determine the amount of

check the extension indicator box on the bottom right hand corner

your extension payment. Attach your payment to the payment form

of Montana Form 2 or 2M or 2EZ and attach a copy of your federal

and mail by April 15, 2010.

Form 4868 “Application for Automatic Extension of Time To File

If you are a fiscal year taxpayer, your payment is due on or before

U.S. Individual Income Tax Return” to your Montana income tax

the 15th day of the fourth month after the close of your tax year.

return. Do not send us a copy of your federal Form 4868 prior to

When you file your Montana income tax return electronically, you represent that you have retained all documents required as a

tax record and that you will provide a copy to the department upon request.

118

1

1 2

2