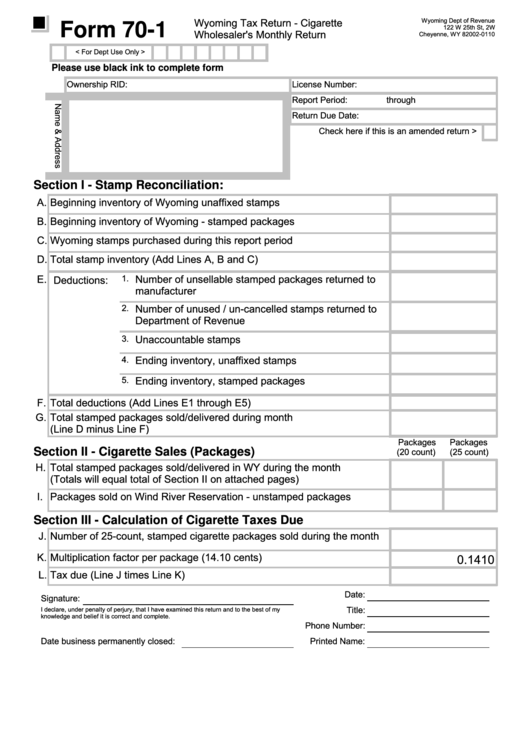

Wyoming Tax Return - Cigarette

Wyoming Dept of Revenue

Form 70-1

122 W 25th St, 2W

Wholesaler's Monthly Return

Cheyenne, WY 82002-0110

< For Dept Use Only >

Please use black ink to complete form

Ownership RID:

License Number:

Report Period:

through

Return Due Date:

Check here if this is an amended return >

Section I - Stamp Reconciliation:

A. Beginning inventory of Wyoming unaffixed stamps

B. Beginning inventory of Wyoming - stamped packages

C. Wyoming stamps purchased during this report period

D. Total stamp inventory (Add Lines A, B and C)

E. Deductions:

Number of unsellable stamped packages returned to

1.

manufacturer

2.

Number of unused / un-cancelled stamps returned to

Department of Revenue

Unaccountable stamps

3.

4.

Ending inventory, unaffixed stamps

5.

Ending inventory, stamped packages

F. Total deductions (Add Lines E1 through E5)

G. Total stamped packages sold/delivered during month

(Line D minus Line F)

Packages

Packages

(20 count)

(25 count)

Section II - Cigarette Sales (Packages)

H.

Total stamped packages sold/delivered in WY during the month

(Totals will equal total of Section II on attached pages)

I. Packages sold on Wind River Reservation - unstamped packages

Section III - Calculation of Cigarette Taxes Due

J. Number of 25-count, stamped cigarette packages sold during the month

K. Multiplication factor per package (14.10 cents)

0.1410

L. Tax due (Line J times Line K)

Date:

Signature:

Title:

I declare, under penalty of perjury, that I have examined this return and to the best of my

knowledge and belief it is correct and complete.

Phone Number:

Date business permanently closed:

Printed Name:

1

1