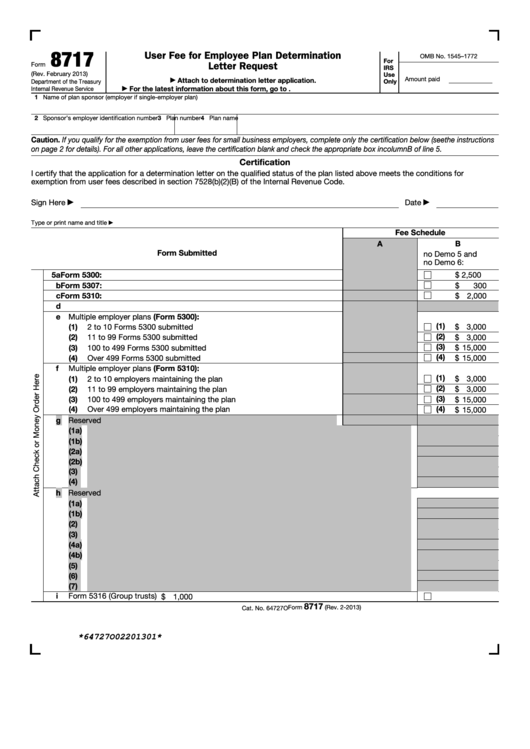

8717

User Fee for Employee Plan Determination

OMB No. 1545–1772

For

Letter Request

Form

IRS

(Rev. February 2013)

Use

Amount paid

Attach to determination letter application.

▶

Department of the Treasury

Only

For the latest information about this form, go to

Internal Revenue Service

▶

1 Name of plan sponsor (employer if single-employer plan)

2 Sponsor’s employer identification number

3 Plan number

4 Plan name

Caution. If you qualify for the exemption from user fees for small business employers, complete only the certification below (see the instructions

on page 2 for details). For all other applications, leave the certification blank and check the appropriate box in column B of line 5.

Certification

I certify that the application for a determination letter on the qualified status of the plan listed above meets the conditions for

exemption from user fees described in section 7528(b)(2)(B) of the Internal Revenue Code.

Sign Here

Date

▶

▶

Type or print name and title

▶

Fee Schedule

B

A

Form Submitted

no Demo 5 and

no Demo 6:

5a Form 5300:

$ 2,500

b Form 5307:

$

300

c Form 5310:

$ 2,000

d

e Multiple employer plans (Form 5300):

(1)

(1)

2 to 10 Forms 5300 submitted .

.

.

.

.

.

.

.

.

.

.

.

.

.

$ 3,000

(2)

(2)

11 to 99 Forms 5300 submitted

.

.

.

.

.

.

.

.

.

.

.

.

.

$ 3,000

(3)

(3)

100 to 499 Forms 5300 submitted .

.

.

.

.

.

.

.

.

.

.

.

.

$ 15,000

(4)

(4)

Over 499 Forms 5300 submitted .

.

.

.

.

.

.

.

.

.

.

.

.

$ 15,000

f

Multiple employer plans (Form 5310):

(1)

(1)

2 to 10 employers maintaining the plan .

.

.

.

.

.

.

.

.

.

.

$ 3,000

(2)

(2)

11 to 99 employers maintaining the plan

.

.

.

.

.

.

.

.

.

.

$ 3,000

(3)

(3)

100 to 499 employers maintaining the plan .

.

.

.

.

.

.

.

.

.

$ 15,000

(4)

Over 499 employers maintaining the plan

.

.

.

.

.

.

.

.

.

.

(4)

$ 15,000

g Reserved

(1a)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(1b)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(2a)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(2b)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(3)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(4)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

h Reserved

(1a)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(1b)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(2)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(3)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(4a)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(4b)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(5)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(6)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(7)

i

Form 5316 (Group trusts)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$ 1,000

8717

Form

(Rev. 2-2013)

Cat. No. 64727O

*64727O02201301*

1

1 2

2