Form 8718 - User Fee For Exempt Organization Determination Letter Request

ADVERTISEMENT

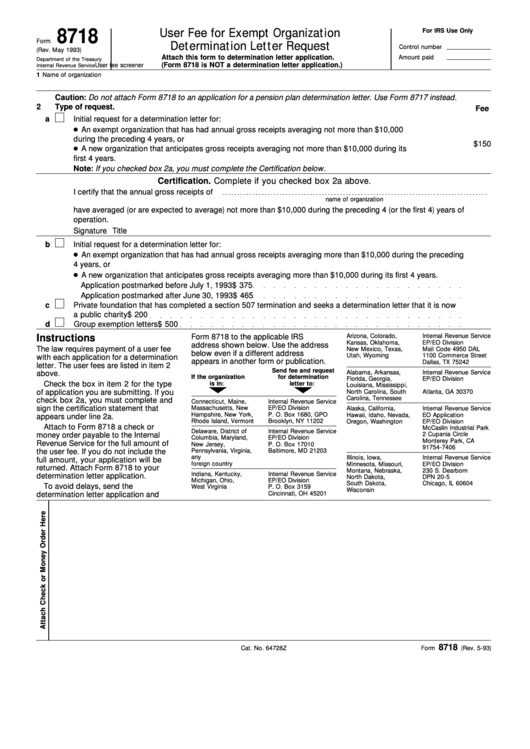

8718

For IRS Use Only

User Fee for Exempt Organization

Form

Determination Letter Request

Control number

(Rev. May 1993)

Attach this form to determination letter application.

Amount paid

Department of the Treasury

(Form 8718 is NOT a determination letter application.)

Internal Revenue Service

User fee screener

1 Name of organization

Caution: Do not attach Form 8718 to an application for a pension plan deter mination letter. Use For m 8717 instead.

2

Type of request.

Fee

a

Initial request for a determination letter for:

An exempt organization that has had annual gross receipts averaging not more than $10,000

during the preceding 4 years, or

$150

A new organization that anticipates gross receipts averaging not more than $10,000 during its

first 4 years.

Note: If you checked box 2a, you must complete the Certification below.

Certification. Complete if you checked box 2a above.

I certify that the annual gross receipts of

name of organization

have averaged (or are expected to average) not more than $10,000 during the preceding 4 (or the first 4) years of

operation.

Signature

Title

b

Initial request for a determination letter for:

An exempt organization that has had annual gross receipts averaging more than $10,000 during the preceding

4 years, or

A new organization that anticipates gross receipts averaging more than $10,000 during its first 4 years.

Application postmarked before July 1, 1993

$ 375

Application postmarked after June 30, 1993

$ 465

c

Private foundation that has completed a section 507 termination and seeks a determination letter that it is now

a public charity

$ 200

d

Group exemption letters

$ 500

Instructions

Form 8718 to the applicable IRS

Arizona, Colorado,

Internal Revenue Service

Kansas, Oklahoma,

EP/EO Division

address shown below. Use the address

The law requires payment of a user fee

New Mexico, Texas,

Mail Code 4950 DAL

below even if a different address

Utah, Wyoming

1100 Commerce Street

with each application for a determination

appears in another form or publication.

Dallas, TX 75242

letter. The user fees are listed in item 2

Send fee and request

Alabama, Arkansas,

Internal Revenue Service

above.

If the organization

for determination

Florida, Georgia,

EP/EO Division

Check the box in item 2 for the type

is in:

letter to:

Louisiana, Mississippi,

P.O. Box 941

of application you are submitting. If you

North Carolina, South

Atlanta, GA 30370

Carolina, Tennessee

check box 2a, you must complete and

Connecticut, Maine,

Internal Revenue Service

sign the certification statement that

Massachusetts, New

EP/EO Division

Alaska, California,

Internal Revenue Service

Hampshire, New York,

P. O. Box 1680, GPO

Hawaii, Idaho, Nevada,

EO Application

appears under line 2a.

Rhode Island, Vermont

Brooklyn, NY 11202

Oregon, Washington

EP/EO Division

Attach to Form 8718 a check or

McCaslin Industrial Park

Delaware, District of

Internal Revenue Service

money order payable to the Internal

2 Cupania Circle

Columbia, Maryland,

EP/EO Division

Monterey Park, CA

Revenue Service for the full amount of

New Jersey,

P. O. Box 17010

91754-7406

the user fee. If you do not include the

Pennsylvania, Virginia,

Baltimore, MD 21203

any U.S. possession or

Illinois, Iowa,

Internal Revenue Service

full amount, your application will be

foreign country

Minnesota, Missouri,

EP/EO Division

returned. Attach Form 8718 to your

Montana, Nebraska,

230 S. Dearborn

Indiana, Kentucky,

Internal Revenue Service

determination letter application.

North Dakota,

DPN 20-5

Michigan, Ohio,

EP/EO Division

South Dakota,

Chicago, IL 60604

To avoid delays, send the

West Virginia

P. O. Box 3159

Wisconsin

Cincinnati, OH 45201

determination letter application and

8718

Cat. No. 64728Z

Form

(Rev. 5-93)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1