Instructions For Schedule 2 (Form 1040a) - Child And Dependent Care Expenses For Form 1040a Filers - 2004 Page 2

ADVERTISEMENT

cost. But do not include the cost of schooling for a child in the first

W-10 completed by the care provider. Or you may keep one of the

grade or above. Also, do not include any expenses for sending your

other sources of information listed in the instructions for Form

child to an overnight camp.

W-10. If the provider does not give you the information, complete

the entries you can on line 1. For example, enter the provider’s

Medical expenses. Some disabled spouse and dependent care

name and address. Enter “See Page 2” in the columns for which you

expenses may qualify as medical expenses if you itemize deduc-

do not have the information. Then, on the bottom of page 2, explain

tions. But you must use Form 1040. See Pub. 503 and Pub. 502 for

that the provider did not give you the information you asked for.

details.

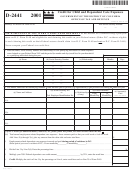

Columns (a) and (b).

Enter the care provider’s name and address. If

you were covered by your employer’s dependent care plan and your

Who Can Take the Credit or Exclude

employer furnished the care (either at your workplace or by hiring a

care provider), enter your employer’s name in column (a). Next,

Dependent Care Benefits?

enter “See W-2” in column (b). Then, leave columns (c) and (d)

You can take the credit or the exclusion if all six of the following

blank. But if your employer paid a third party (not hired by your

apply.

employer) on your behalf to provide the care, you must give infor-

mation on the third party in columns (a) through (d).

1. Your filing status is single, head of household, qualifying

widow(er), or married filing jointly. But see Married persons filing

Column (c).

If the care provider is an individual, enter his or her

separate returns on this page.

social security number (SSN). Otherwise, enter the provider’s em-

2. The care was provided so you (and your spouse if you were

ployer identification number (EIN). If the provider is a tax-exempt

married) could work or look for work. However, if you did not find

organization, enter “Tax-Exempt.”

a job and have no earned income for the year, you cannot take the

credit or the exclusion. But if your spouse was a student or disabled,

Column (d).

Enter the total amount you actually paid in 2004 to the

see the instructions for line 5.

care provider. Also, include amounts your employer paid to a third

party on your behalf. It does not matter when the expenses were

3. You (and your spouse if you were married) paid over half the

cost of keeping up your home. The cost includes rent, mortgage

incurred. Do not reduce this amount by any reimbursement you

interest, real estate taxes, utilities, home repairs, insurance on the

received.

home, and food eaten at home.

4. You and the qualifying person(s) lived in the same home.

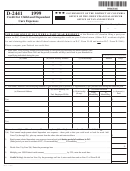

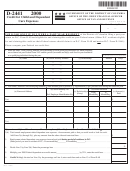

Part II

5. The person who provided the care was not your spouse or a

person whom you can claim as a dependent. If your child provided

Credit for Child and Dependent Care

the care, he or she must have been age 19 or older by the end of

Expenses

2004.

6. You report the required information about the care provider

Line 2

on line 1 and, if taking the credit, the information about the qualify-

ing person on line 2.

Complete columns (a) through (c) for each qualifying person. If you

have more than two qualifying persons, attach a statement to your

return with the required information. Be sure to put your name and

If your filing status is

Married persons filing separate returns.

social security number (SSN) on the statement. Also, enter “See

married filing separately and all of the following apply, you are

Attached” in the space to the left of line 3.

considered unmarried for purposes of figuring the credit and the

exclusion on Schedule 2.

Enter each qualifying person’s name.

Column (a).

•

You lived apart from your spouse during the last 6 months of

2004, and

Column (b).

You must enter the qualifying person’s SSN. Be sure

•

the name and SSN entered agree with the person’s social security

The qualifying person lived in your home more than half of

card. Otherwise, at the time we process your return, we may reduce

2004, and

•

or disallow your credit. If the person was born and died in 2004 and

You provided over half the cost of keeping up your home.

did not have an SSN, enter “Died” in column (b) and attach a copy

of the person’s birth certificate. To find out how to get an SSN, see

If you meet all the requirements to be treated as unmarried and

Social Security Number (SSN) on page 18 of the Form 1040A in-

meet items 2 through 6 listed earlier, you can take the credit or the

structions. If the name or SSN on the person’s social security card is

exclusion. If you do not meet all the requirements to be treated as

not correct, call the Social Security Administration at

unmarried, you cannot take the credit. However, you can take the

1-800-772-1213.

exclusion if you meet items 2 through 6.

Column (c).

Enter the qualified expenses you incurred and paid in

2004 for the person listed in column (a). Prepaid expenses are

Part I

treated as paid in the year the care is provided. Do not include in

Persons or Organizations Who Provided the

column (c) qualified expenses:

•

Care

You incurred in 2004 but did not pay until 2005. You may be

able to use these expenses to increase your 2005 credit.

•

Line 1

You incurred in 2003 but did not pay until 2004. Instead, see

the instructions for line 9.

Complete columns (a) through (d) for each person or organization

•

You prepaid in 2004 for care to be provided in 2005. These

that provided the care. You can use Form W-10 or any other source

expenses can only be used to figure your 2005 credit.

listed in its instructions to get the information from the care pro-

vider. If you do not give correct or complete information, your

If you paid qualified expenses for the care of two or

credit (and exclusion, if applicable) may be disallowed unless you

more qualifying persons, the $6,000 limit does not need

TIP

can show you used due diligence in trying to get the required infor-

to be divided equally. For example, if you incurred and

mation.

paid $2,500 of qualifying expenses for the care of one

qualifying person and $3,500 for the care of another qualifying per-

Due diligence.

You can show a serious and earnest effort (due dili-

son, you can use the total, $6,000, to figure the credit.

gence) to get the information by keeping in your records a Form

Sch. 2-2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3