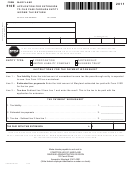

2013

APPLICATION FOR EXTENSION TO

MARYLAND

FORM

FILE PASS-THROUGH ENTITY INCOME

510E

TAX RETURN INSTRUCTIONS

Purpose of Form Maryland law provides for an extension of

How to file Complete the Tax Payment Worksheet.

time to file the pass-through entity income tax return (Form

If line 3 is zero, file in one of the following ways:

510), but not to pay the tax due. Use Form 510E to remit any

1) Telefile Request an automatic extension by calling 410-

tax that may be due. Also use Form 510E if this is the first

260-7829 from Central Maryland or 1-800-260-3664

filing of the entity, even if no tax is due.

from elsewhere to telefile this form. Please have the form

Note: Do not use this form for corporations (except

available when making this call.

S corporations) or to remit employer withholding tax.

NOTE: Telefile service is available 24 hours a day, 7 days

General Requirements Extensions are allowable for up to

a week. Calling during non-peak hours will make it easier

seven months from the original due date for S corporations

to file.

and up to six months from the original due date for all other

2) Internet File the extension at

pass-through entities. An automatic extension will be granted

com and look for Online Services/Services for Business.

if Form 510E is filed by the original due date.

If filed by Internet, do not mail 510E; retain it with the

• If no tax is due - File the extension online or telefile.

company’s records.

You must use Form 510E if this is the first filing of the

3) Filing electronically using Modernized Electronic Filing

entity.

method (software provider must be approved by the IRS

• If tax is due - Make full payment by using Form 510E.

and Revenue Administration Division). If filed

Do not mail the Form 510E if, after completing the Tax

electronically, do not mail 510E; retain it with the

Payment Worksheet, no additional tax is due. Instead,

company’s records.

you may telefile or file on our Web site unless this is the first

4) First filing of entity Mail Form 510E.

filing of the pass-through entity. However, if an unpaid liability

If line 3 shows an amount due.

is disclosed when the return is filed, penalty and interest

charges may be due in addition to the tax.

1) Filing electronically using Modernized Electronic Filing

method (software provider must be approved by the IRS

When to file File Form 510E by the 15th day of the third

and Revenue Administration Division). If filed

month following the close of the tax year or period for an S

electronically, do not mail 510E; retain it with

corporation or by the 15th day of the fourth month for all

company’s records.

other pass-through entities.

2) Payment Instructions Include a check or money order

Name, Address and Other Information Type or print the

made payable to Comptroller of Maryland. All payments

required information in the designated area.

must indicate the FEIN, type of tax and tax year beginning

Enter the exact pass-through entity name and continue with

and ending dates. DO NOT SEND CASH.

any “Trading As” (T/A) name, if applicable.

Mail payment and completed Form 510E to:

Enter the Federal Employer Identification Number (FEIN). If a

Comptroller of Maryland

FEIN has not been secured, enter “APPLIED FOR” followed by

Revenue Administration Division

the date of application. If a FEIN has not been applied for, do so

110 Carroll Street

immediately.

Annapolis, MD 21411-0001

Check the applicable box for type of entity.

Tax Year or Period Enter the beginning and ending dates of

the tax year in the space provided if the tax year is other than

a calendar year.

The same tax year or period used for the federal return must

be used for Form 510E.

COM/RAD 008

13-49

1

1 2

2