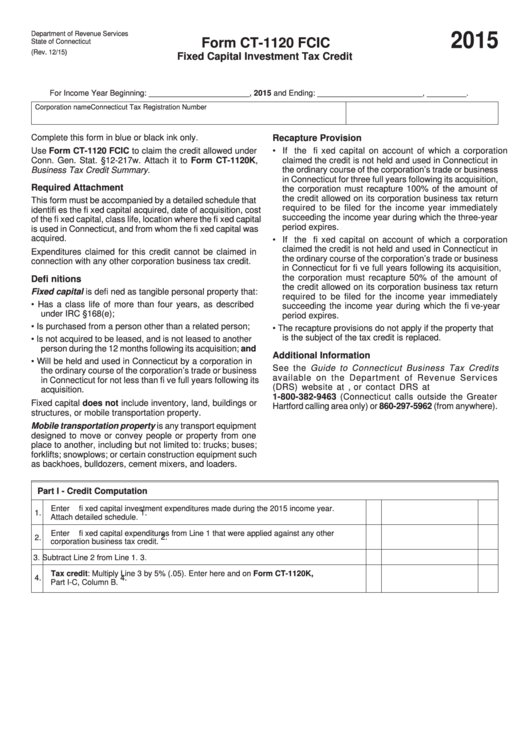

Form Ct-1120 Fcic - Fixed Capital Investment Tax Credit - 2015

ADVERTISEMENT

Department of Revenue Services

2015

Form CT-1120 FCIC

State of Connecticut

(Rev.

12/15

)

Fixed Capital Investment Tax Credit

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Recapture Provision

Use Form CT-1120 FCIC to claim the credit allowed under

• If the fi xed capital on account of which a corporation

Conn. Gen. Stat. §12-217w. Attach it to Form CT-1120K,

claimed the credit is not held and used in Connecticut in

Business Tax Credit Summary.

the ordinary course of the corporation’s trade or business

in Connecticut for three full years following its acquisition,

Required Attachment

the corporation must recapture 100% of the amount of

the credit allowed on its corporation business tax return

This form must be accompanied by a detailed schedule that

required to be filed for the income year immediately

identifi es the fi xed capital acquired, date of acquisition, cost

succeeding the income year during which the three-year

of the fi xed capital, class life, location where the fi xed capital

period expires.

is used in Connecticut, and from whom the fi xed capital was

acquired.

• If the fi xed capital on account of which a corporation

claimed the credit is not held and used in Connecticut in

Expenditures claimed for this credit cannot be claimed in

the ordinary course of the corporation’s trade or business

connection with any other corporation business tax credit.

in Connecticut for fi ve full years following its acquisition,

the corporation must recapture 50% of the amount of

Defi nitions

the credit allowed on its corporation business tax return

Fixed capital is defi ned as tangible personal property that:

required to be filed for the income year immediately

• Has a class life of more than four years, as described

succeeding the income year during which the fi ve-year

under IRC §168(e);

period expires.

• Is purchased from a person other than a related person;

• The recapture provisions do not apply if the property that

is the subject of the tax credit is replaced.

• Is not acquired to be leased, and is not leased to another

person during the 12 months following its acquisition; and

Additional Information

• Will be held and used in Connecticut by a corporation in

See the Guide to Connecticut Business Tax Credits

the ordinary course of the corporation’s trade or business

available on the Department of Revenue Services

in Connecticut for not less than fi ve full years following its

(DRS) website at , or contact DRS at

acquisition.

1-800-382-9463 (Connecticut calls outside the Greater

Fixed capital does not include inventory, land, buildings or

Hartford calling area only) or 860-297-5962 (from anywhere).

structures, or mobile transportation property.

Mobile transportation property is any transport equipment

designed to move or convey people or property from one

place to another, including but not limited to: trucks; buses;

forklifts; snowplows; or certain construction equipment such

as backhoes, bulldozers, cement mixers, and loaders.

Part I - Credit Computation

Enter fi xed capital investment expenditures made during the 2015 income year.

1.

1.

Attach detailed schedule.

Enter fi xed capital expenditures from Line 1 that were applied against any other

2.

2.

corporation business tax credit.

3.

Subtract Line 2 from Line 1.

3.

Tax credit: Multiply Line 3 by 5% (.05). Enter here and on Form CT-1120K,

4.

4.

Part I-C, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2