Clear Form

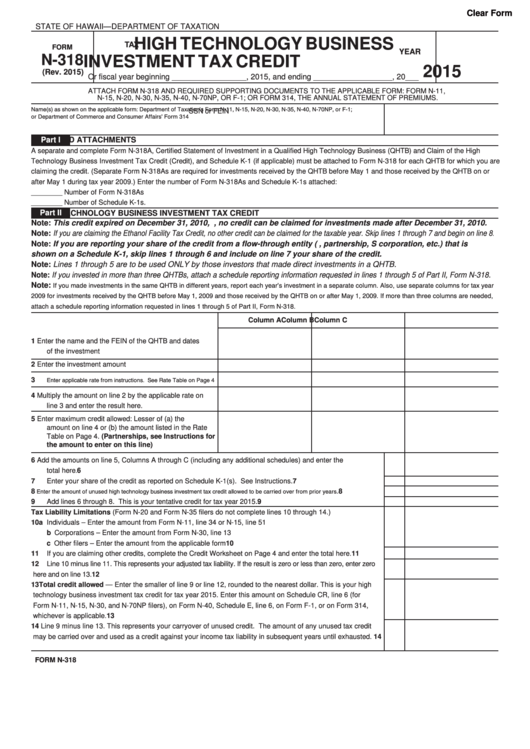

STATE OF HAWAII—DEPARTMENT OF TAXATION

HIGH TECHNOLOGY BUSINESS

TAX

FORM

YEAR

N-318

INVESTMENT TAX CREDIT

2015

(Rev. 2015)

Or fiscal year beginning _________________, 2015, and ending __________________, 20___

ATTACH FORM N-318 AND REQUIRED SUPPORTING DOCUMENTS TO THE APPLICABLE FORM: FORM N-11,

N-15, N-20, N-30, N-35, N-40, N-70NP, OR F-1; OR FORM 314, THE ANNUAL STATEMENT OF PREMIUMS.

Name(s) as shown on the applicable form: Department of Taxation’s Form N-11, N-15, N-20, N-30, N-35, N-40, N-70NP, or F-1;

SSN or FEIN

or Department of Commerce and Consumer Affairs’ Form 314

Part I

REQUIRED ATTACHMENTS

A separate and complete Form N-318A, Certified Statement of Investment in a Qualified High Technology Business (QHTB) and Claim of the High

Technology Business Investment Tax Credit (Credit), and Schedule K-1 (if applicable) must be attached to Form N-318 for each QHTB for which you are

claiming the credit. (Separate Form N-318As are required for investments received by the QHTB before May 1 and those received by the QHTB on or

after May 1 during tax year 2009.) Enter the number of Form N-318As and Schedule K-1s attached:

________ Number of Form N-318As

________ Number of Schedule K-1s.

Part II

H

HIGH TECHNOLOGY BUSINESS INVESTMENT TAX CREDIT

Note: This credit expired on December 31, 2010, i.e., no credit can be claimed for investments made after December 31, 2010.

Note: If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the taxable year. Skip lines 1 through 7 and begin on line 8.

Note: If you are reporting your share of the credit from a flow-through entity (e.g., partnership, S corporation, etc.) that is

shown on a Schedule K-1, skip lines 1 through 6 and include on line 7 your share of the credit.

Note: Lines 1 through 5 are to be used ONLY by those investors that made direct investments in a QHTB.

Note: If you invested in more than three QHTBs, attach a schedule reporting information requested in lines 1 through 5 of Part II, Form N-318.

Note: If you made investments in the same QHTB in different years, report each year’s investment in a separate column. Also, use separate columns for tax year

2009 for investments received by the QHTB before May 1, 2009 and those received by the QHTB on or after May 1, 2009. If more than three columns are needed,

attach a schedule reporting information requested in lines 1 through 5 of Part II, Form N-318.

Column A

Column B

Column C

1

Enter the name and the FEIN of the QHTB and dates

of the investment ..........................................................

2

Enter the investment amount ........................................

3

Enter applicable rate from instructions. See Rate Table on Page 4

4

Multiply the amount on line 2 by the applicable rate on

line 3 and enter the result here. ...................................

5

Enter maximum credit allowed: Lesser of (a) the

amount on line 4 or (b) the amount listed in the Rate

Table on Page 4. (Partnerships, see Instructions for

the amount to enter on this line) ...............................

6

Add the amounts on line 5, Columns A through C (including any additional schedules) and enter the

total here. .................................................................................................................................................................................................

6

7

Enter your share of the credit as reported on Schedule K-1(s). See Instructions. .........................................................

7

8

Enter the amount of unused high technology business investment tax credit allowed to be carried over from prior years. .......................

8

9

Add lines 6 through 8. This is your tentative credit for tax year 2015. ................................................................................

9

Tax Liability Limitations (Form N-20 and Form N-35 filers do not complete lines 10 through 14.)

10

a Individuals – Enter the amount from Form N-11, line 34 or N-15, line 51

b Corporations – Enter the amount from Form N-30, line 13

c Other filers – Enter the amount from the applicable form ...................................................................................................

10

11

If you are claiming other credits, complete the Credit Worksheet on Page 4 and enter the total here. ....................

11

12

Line 10 minus line 11. This represents your adjusted tax liability. If the result is zero or less than zero, enter zero

12

here and on line 13. ...............................................................................................................................................

13

Total credit allowed — Enter the smaller of line 9 or line 12, rounded to the nearest dollar. This is your high

technology business investment tax credit for tax year 2015. Enter this amount on Schedule CR, line 6 (for

Form N-11, N-15, N-30, and N-70NP filers), on Form N-40, Schedule E, line 6, on Form F-1, or on Form 314,

13

whichever is applicable. ........................................................................................................................................

14

Line 9 minus line 13. This represents your carryover of unused credit. The amount of any unused tax credit

14

may be carried over and used as a credit against your income tax liability in subsequent years until exhausted.

FORM N-318

1

1 2

2 3

3 4

4