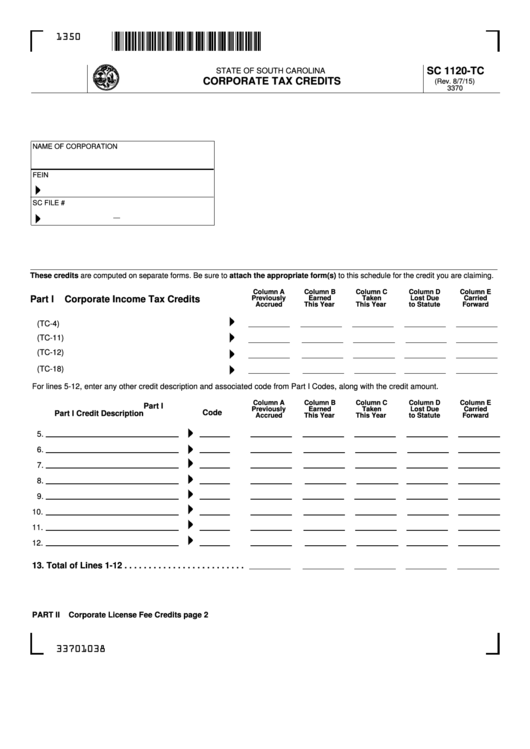

Form Sc 1120-Tc - Corporate Tax Credits

ADVERTISEMENT

1350

SC 1120-TC

STATE OF SOUTH CAROLINA

CORPORATE TAX CREDITS

(Rev. 8/7/15)

3370

NAME OF CORPORATION

FEIN

SC FILE #

These credits are computed on separate forms. Be sure to attach the appropriate form(s) to this schedule for the credit you are claiming.

Column A

Column B

Column C

Column D

Column E

Part I

Corporate Income Tax Credits

Previously

Earned

Taken

Lost Due

Carried

Accrued

This Year

This Year

to Statute

Forward

1. New Jobs Credit (TC-4)

2. Capital Investment Credit (TC-11)

3. Family Independence Payments Credit (TC-12)

4. Research Expenses Credit (TC-18)

For lines 5-12, enter any other credit description and associated code from Part I Codes, along with the credit amount.

Column A

Column B

Column C

Column D

Column E

Part I

Previously

Earned

Taken

Lost Due

Carried

Code

Part I Credit Description

Accrued

This Year

This Year

to Statute

Forward

5.

6.

7.

8.

9.

10.

11.

12.

13. Total of Lines 1-12 . . . . . . . . . . . . . . . . . . . . . . . . .

PART II

Corporate License Fee Credits page 2

33701038

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4