Iowa Department of Revenue

https://tax.iowa.gov

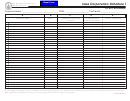

IA Corporation Schedule J1 and J2

Consolidated Business Activity Ratio

Corporation Name:

Tax Period:

Federal Employer Identification Number (FEIN):

Instructions for Schedules J1 and J2 Consolidated Business Activity Ratio: For each company listed on Schedule I, list the receipts in

Iowa and the receipts everywhere. Any adjustments for intercompany transactions or other consolidating adjustments should be shown in the

adjustments column. Total the columns for each row, subtracting or adding the adjustments as needed. Use additional Schedules J1 and J2 when

necessary. See instructions for Schedule E for further explanations. Include an explanation if the company has zero Iowa receipts but is included in

the consolidated group.

Schedule J1: Receipts in Iowa

FEIN

FEIN

FEIN

FEIN

FEIN

Type of Income

Adjustments

Total

1. Gross Receipts ......................................

2. Net Dividends .........................................

3. Exempt Interest ........................................

4. Accounts Receivable Interest ................

5. Other Interest ...........................................

6. Rent ..........................................................

7. Royalties ..................................................

8. Capital Gains ............................................

9. Ordinary Gains .........................................

10. Partnership Gross Receipts. Include

schedule. ..................................................

11. Other. Include schedule. ..........................

12. Total (to Iowa Schedule E) .......................

Schedule J2: Receipts Everywhere

FEIN

FEIN

FEIN

FEIN

FEIN

Type of Income

Adjustments

Total

1. Gross Receipts ........................................

2. Net Dividends...........................................

3. Exempt Interest ........................................

4. Accounts Receivable Interest ..................

5. Other Interest ...........................................

6. Rent .........................................................

7. Royalties ..................................................

8. Capital Gains ...........................................

9. Ordinary Gains .........................................

10. Partnership Gross Receipts. Include

schedule. ..................................................

11. Other. Include schedule. ..........................

12. Total (to Iowa Schedule E) ......................

42-022b (09/11/15)

1

1 2

2