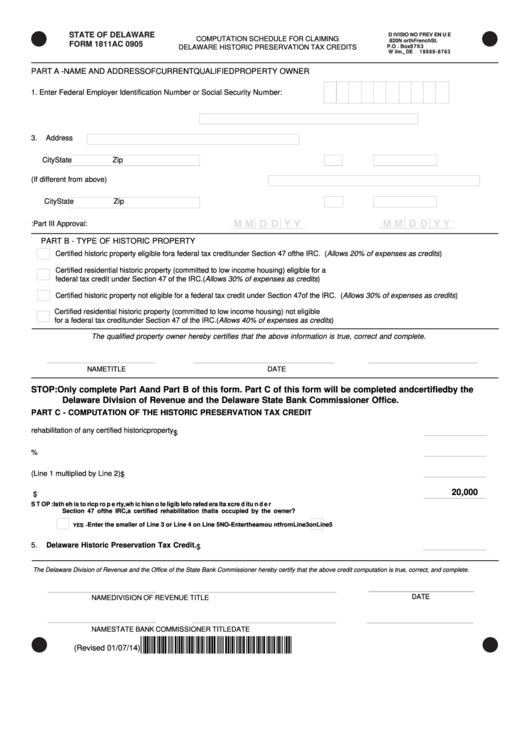

Form 1811ac - Computation Schedule For Claiming Delaware Historic Preservation Tax Credits

ADVERTISEMENT

STATE OF DELAWARE

D IV ISIO N O F REV EN U E

COMPUTATION SCHEDULE FOR CLAIMING

8 2 0 N o rt h F re n ch St .

FORM 1811AC 0905

DELAWARE HISTORIC PRESERVATION TAX CREDITS

P .O . Bo x 8 763

W ilm

.,

DE

19899 - 8763

PART A - NAME AND ADDRESS OF CURRENT QUALIFIED PROPERTY OWNER

1. Enter Federal Employer Identification Number

or

Social Security Number:

2. Name of Current Qualified Property Owner

3.

Address

City

State

Zip

4. Location of Qualifying Historic Property (If different from above)

City

State

Zip

5. Qualifying Dates

Part II Approval:

Part III Approval:

PART B - TYPE OF HISTORIC PROPERTY

Certified historic property eligible for a federal tax credit under Section 47 of the IRC. (Allows 20% of expenses as credits)

Certified residential historic property (committed to low income housing) eligible for a

federal tax credit under Section 47 of the IRC. (Allows 30% of expenses as credits)

Certified historic property not eligible for a federal tax credit under Section 47 of the IRC. (Allows 30% of expenses as credits)

Certified residential historic property (committed to low income housing) not eligible

for a federal tax credit under Section 47 of the IRC. (Allows 40% of expenses as credits)

The qualified property owner hereby certifies that the above information is true, correct and complete.

NAME

TITLE

DATE

STOP: Only complete Part A and Part B of this form. Part C of this form will be completed and certified by the

Delaware Division of Revenue and the Delaware State Bank Commissioner Office.

PART C - COMPUTATION OF THE HISTORIC PRESERVATION TAX CREDIT

1.

Qualified expenditures in the rehabilitation of any certified historic property

$

%

2.

Multiply Line 1 by the percentage selected in Part B

3.

Tentative Historic Preservation Tax Credit. (Line 1 multiplied by Line 2)

$

20,000

4.

Credit limitation

$

S T O P :

Is t h e h is t o r ic p r o p e r t y, w h ic h is n o t e lig ib le f o r a f e d er a l ta x cr e d it u n d e r

S ec tio n 4 7 o f th e IR C , a cer tifie d re h a b ilita tio n th a t is o c c u p ie d b y th e o w n e r?

Enter the smaller of Line 3 or Line 4 on Line 5

N O - E n te r th e a m ou n t fro m L in e 3 o n L in e 5

YES -

5.

Delaware Historic Preservation Tax Credit.

$

The Delaware Division of Revenue and the Office of the State Bank Commissioner hereby certify that the above credit computation is true, correct, and complete.

DATE

NAME

DIVISION OF REVENUE TITLE

NAME

STATE BANK COMMISSIONER TITLE

DATE

*DF41813019999*

(Revised 01/07/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2