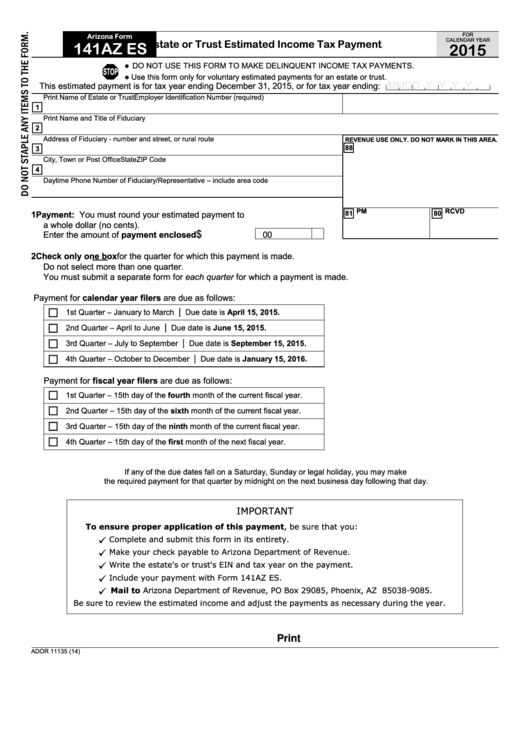

FOR

Arizona Form

CALENDAR YEAR

Estate or Trust Estimated Income Tax Payment

141AZ ES

2015

DO NOT USE THIS FORM TO MAKE DELINQUENT INCOME TAX PAYMENTS.

STOP

Use this form only for voluntary estimated payments for an estate or trust.

M M D D Y Y Y Y

This estimated payment is for tax year ending December 31, 2015, or for tax year ending:

Print Name of Estate or Trust

Employer Identification Number (required)

1

Print Name and Title of Fiduciary

2

Address of Fiduciary - number and street, or rural route

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

3

City, Town or Post Office

State

ZIP Code

4

Daytime Phone Number of Fiduciary/Representative – include area code

81 PM

80 RCVD

1 Payment: You must round your estimated payment to

a whole dollar (no cents).

$

Enter the amount of payment enclosed...................

00

2 Check only one box for the quarter for which this payment is made.

Do not select more than one quarter.

You must submit a separate form for each quarter for which a payment is made.

Payment for calendar year filers are due as follows:

|

1st Quarter – January to March

Due date is April 15, 2015.

|

2nd Quarter – April to June

Due date is June 15, 2015.

|

Due date is September 15, 2015.

3rd Quarter – July to September

|

4th Quarter – October to December

Due date is January 15, 2016.

Payment for fiscal year filers are due as follows:

1st Quarter – 15th day of the fourth month of the current fiscal year.

2nd Quarter – 15th day of the sixth month of the current fiscal year.

3rd Quarter – 15th day of the ninth month of the current fiscal year.

4th Quarter – 15th day of the first month of the next fiscal year.

If any of the due dates fall on a Saturday, Sunday or legal holiday, you may make

the required payment for that quarter by midnight on the next business day following that day.

IMPORTANT

To ensure proper application of this payment, be sure that you:

Complete and submit this form in its entirety.

Make your check payable to Arizona Department of Revenue.

Write the estate's or trust's EIN and tax year on the payment.

Include your payment with Form 141AZ ES.

Mail to Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085.

Be sure to review the estimated income and adjust the payments as necessary during the year.

Print

ADOR 11135 (14)

1

1