Form Ia 1041v - Fiduciary Income Tax Payment Voucher - Iowa Fiduciary Income Tax

ADVERTISEMENT

Iowa Department of Revenue

https://tax.iowa.gov

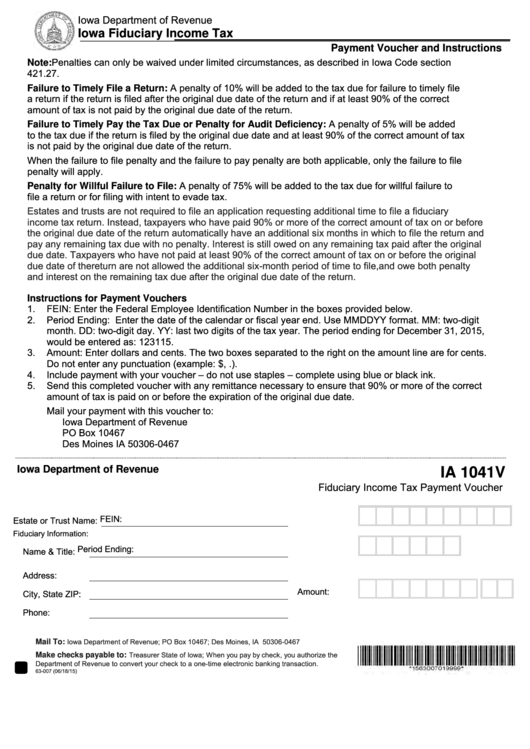

Iowa Fiduciary Income Tax

Payment Voucher and Instructions

Note: Penalties can only be waived under limited circumstances, as described in Iowa Code section

421.27.

Failure to Timely File a Return: A penalty of 10% will be added to the tax due for failure to timely file

a return if the return is filed after the original due date of the return and if at least 90% of the correct

amount of tax is not paid by the original due date of the return.

Failure to Timely Pay the Tax Due or Penalty for Audit Deficiency: A penalty of 5% will be added

to the tax due if the return is filed by the original due date and at least 90% of the correct amount of tax

is not paid by the original due date of the return.

When the failure to file penalty and the failure to pay penalty are both applicable, only the failure to file

penalty will apply.

Penalty for Willful Failure to File: A penalty of 75% will be added to the tax due for willful failure to

file a return or for filing with intent to evade tax.

Estates and trusts are not required to file an application requesting additional time to file a fiduciary

income tax return. Instead, taxpayers who have paid 90% or more of the correct amount of tax on or before

the original due date of the return automatically have an additional six months in which to file the return and

pay any remaining tax due with no penalty. Interest is still owed on any remaining tax paid after the original

due date. Taxpayers who have not paid at least 90% of the correct amount of tax on or before the original

due date of the return are not allowed the additional six-month period of time to file, and owe both penalty

and interest on the remaining tax due after the original due date of the return.

Instructions for Payment Vouchers

1.

FEIN: Enter the Federal Employee Identification Number in the boxes provided below.

2.

Period Ending: Enter the date of the calendar or fiscal year end. Use MMDDYY format. MM: two-digit

month. DD: two-digit day. YY: last two digits of the tax year. The period ending for December 31, 2015,

would be entered as: 123115.

3.

Amount: Enter dollars and cents. The two boxes separated to the right on the amount line are for cents.

Do not enter any punctuation (example: $, .).

4.

Include payment with your voucher – do not use staples – complete using blue or black ink.

5.

Send this completed voucher with any remittance necessary to ensure that 90% or more of the correct

amount of tax is paid on or before the expiration of the original due date.

Mail your payment with this voucher to:

Iowa Department of Revenue

PO Box 10467

Des Moines IA 50306-0467

Iowa Department of Revenue

IA 1041V

Fiduciary Income Tax Payment Voucher

FEIN:

Estate or Trust Name:

Fiduciary Information:

Period Ending:

Name & Title:

Address:

Amount:

City, State ZIP:

Phone:

Iowa Department of Revenue; PO Box 10467; Des Moines, IA 50306-0467

Mail To:

Treasurer State of Iowa; When you pay by check, you authorize the

Make checks payable to:

Department of Revenue to convert your check to a one-time electronic banking transaction.

63-007 (06/18/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1