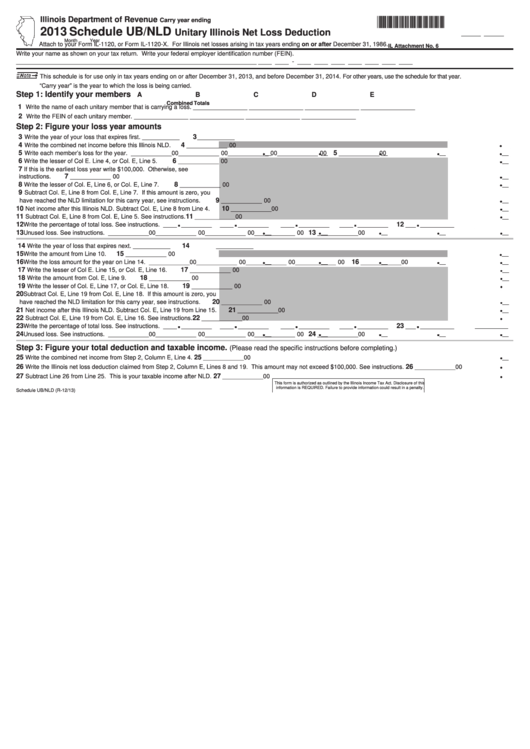

*333601110*

Illinois Department of Revenue

Carry year ending

2013 Schedule UB/NLD

Unitary Illinois Net Loss Deduction

Month

Year

Attach to your Form IL-1120, or Form IL-1120-X. For Illinois net losses arising in tax years ending on or after December 31, 1986.

IL Attachment No. 6

Write your name as shown on your tax return.

Write your federal employer identification number (FEIN).

_______________________________________________________________________

____ ____ - ____ ____ ____ ____ ____ ____ ____

This schedule is for use only in tax years ending on or after December 31, 2013, and before December 31, 2014. For other years, use the schedule for that year.

“Carry year” is the year to which the loss is being carried.

Step 1: Identify your members

A

B

C

D

E

Combined Totals

1

Write the name of each unitary member that is carrying a loss.

________________ ________________ ________________ ________________

2

Write the FEIN of each unitary member.

________________ ________________ ________________ ________________

Step 2: Figure your loss year amounts

3

3

Write the year of your loss that expires first.

___________

___________

4

4

Write the combined net income before this Illinois NLD.

____________ 00

5

5

Write each member’s loss for the year.

____________ 00

____________ 00

____________ 00

____________ 00

____________ 00

6

6

Write the lesser of Col E. Line 4, or Col. E, Line 5.

____________ 00

7

If this is the earliest loss year write $100,000. Otherwise, see

instructions.

7

____________ 00

8

Write the lesser of Col. E, Line 6, or Col. E, Line 7.

8

____________ 00

9

Subtract Col. E, Line 8 from Col. E, Line 7. If this amount is zero, you

9

have reached the NLD limitation for this carry year, see instructions.

____________ 00

10

10

Net income after this Illinois NLD. Subtract Col. E, Line 8 from Line 4.

____________ 00

11

11

Subtract Col. E, Line 8 from Col. E, Line 5. See instructions.

____________ 00

.

.

.

.

.

12

12

Write the percentage of total loss. See instructions.

____

_________

____

_________

____

_________

____

_________

___

__________

13

13

Unused loss. See instructions.

____________ 00

____________ 00

____________ 00

____________ 00

____________ 00

14

14

Write the year of loss that expires next.

___________

___________

15

15

Write the amount from Line 10.

____________ 00

16

16

Write the loss amount for the year on Line 14.

____________ 00

____________ 00

____________ 00

____________ 00

____________ 00

17

17

Write the lesser of Col E. Line 15, or Col. E, Line 16.

____________ 00

18

18

Write the amount from Col. E, Line 9.

____________ 00

19

19

Write the lesser of Col. E, Line 17, or Col. E, Line 18.

____________ 00

20

Subtract Col. E, Line 19 from Col. E, Line 18. If this amount is zero, you

20

have reached the NLD limitation for this carry year, see instructions.

____________ 00

21

21

Net income after this Illinois NLD. Subtract Col. E, Line 19 from Line 15.

____________ 00

22

22

Subtract Col. E, Line 19 from Col. E, Line 16. See instructions.

____________ 00

.

.

.

.

.

23

23

Write the percentage of total loss. See instructions.

____

_________

____

_________

____

_________

____

_________

___

__________

24

24

Unused loss. See instructions.

____________ 00

____________ 00

____________ 00

____________ 00

____________ 00

Step 3: Figure your total deduction and taxable income.

(Please read the specific instructions before completing.)

25

25

Write the combined net income from Step 2, Column E, Line 4.

____________ 00

26

26

Write the Illinois net loss deduction claimed from Step 2, Column E, Lines 8 and 19. This amount may not exceed $100,000. See instructions.

____________ 00

27

27

Subtract Line 26 from Line 25. This is your taxable income after NLD.

____________ 00

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Schedule UB/NLD (R-12/13)

1

1