Reset

Print

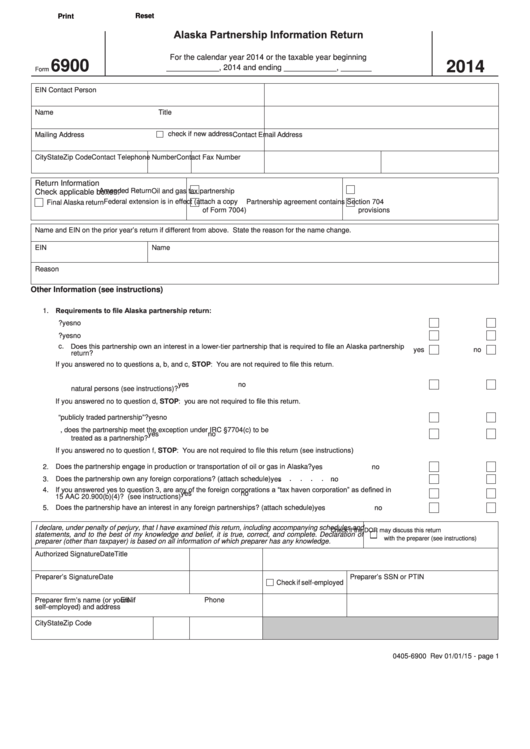

Alaska Partnership Information Return

For the calendar year 2014 or the taxable year beginning

6900

2014

____________, 2014 and ending ____________, _______

Form

EIN

Contact Person

Name

Title

check if new address

Mailing Address

Contact Email Address

City

State

Zip Code

Contact Telephone Number

Contact Fax Number

Return Information

Amended Return

Oil and gas tax partnership

Check applicable boxes:

Federal extension is in effect (attach a copy

Partnership agreement contains Section 704

Final Alaska return

of Form 7004)

provisions

Name and EIN on the prior year’s return if different from above. State the reason for the name change.

EIN

Name

Reason

Other Information (see instructions)

1. Requirements to file Alaska partnership return:

.

.

.

.

.

.

.

.

.

a. Does the Alaska partnership have income derived from sources in Alaska?

yes

no

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b. Does the partnership have assets within Alaska?

yes

no

c. Does this partnership own an interest in a lower-tier partnership that is required to file an Alaska partnership

yes

no

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

return?

If you answered no to questions a, b, and c, STOP: You are not required to file this return.

d. Does the partnership have partners that are other than natural persons or those effectively treated as

yes

no

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

natural persons (see instructions)?

If you answered no to question d, STOP: you are not required to file this return.

e. Is the partnership a “publicly traded partnership”?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

yes

no

f. If you answered yes to question e, does the partnership meet the exception under IRC §7704(c) to be

yes

no

treated as a partnership?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If you answered no to question f, STOP: You are not required to file this return (see instructions)

2. Does the partnership engage in production or transportation of oil or gas in Alaska?

yes

no

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3. Does the partnership own any foreign corporations? (attach schedule)

yes

no

4. If you answered yes to question 3, are any of the foreign corporations a “tax haven corporation” as defined in

yes

no

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15 AAC 20.900(b)(4)? (see instructions)

.

.

.

.

.

.

.

.

5. Does the partnership have an interest in any foreign partnerships? (attach schedule)

yes

no

I declare, under penalty of perjury, that I have examined this return, including accompanying schedules and

Check if the DOR may discuss this return

statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of

with the preparer (see instructions)

preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized Signature

Date

Title

Preparer’s Signature

Date

Preparer’s SSN or PTIN

Check if self-employed

Preparer firm’s name (or yours if

EIN

Phone

self-employed) and address

City

State

Zip Code

0405-6900 Rev 01/01/15 - page 1

1

1 2

2 3

3 4

4