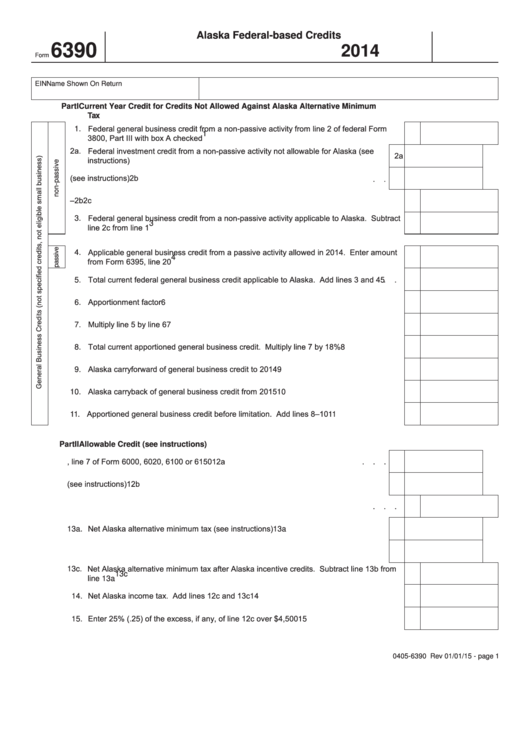

Alaska Federal-based Credits

6390

2014

Form

EIN

Name Shown On Return

Part I Current Year Credit for Credits Not Allowed Against Alaska Alternative Minimum

Tax

1. Federal general business credit from a non-passive activity from line 2 of federal Form

1

3800, Part III with box A checked

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2a. Federal investment credit from a non-passive activity not allowable for Alaska (see

2a

instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b. Other federal general business credits not allowable for Alaska (see instructions)

2b

.

.

2c. Add lines 2a–2b

2c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3. Federal general business credit from a non-passive activity applicable to Alaska. Subtract

3

line 2c from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Applicable general business credit from a passive activity allowed in 2014. Enter amount

4

from Form 6395, line 20

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5. Total current federal general business credit applicable to Alaska. Add lines 3 and 4

.

.

5

6. Apportionment factor

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7. Multiply line 5 by line 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8. Total current apportioned general business credit. Multiply line 7 by 18%

.

.

.

.

.

.

8

9. Alaska carryforward of general business credit to 2014

.

.

.

.

.

.

.

.

.

.

.

9

10. Alaska carryback of general business credit from 2015

.

.

.

.

.

.

.

.

.

.

.

10

11. Apportioned general business credit before limitation. Add lines 8–10

.

.

.

.

.

.

.

11

Part II Allowable Credit (see instructions)

12a. Alaska regular tax from Schedule D, line 7 of Form 6000, 6020, 6100 or 6150

12a

.

.

.

12b. Alaska incentive credits allowed against regular tax (see instructions)

12b

.

.

.

.

.

.

12c. Alaska regular tax after Alaska incentive credits. Subtract line 12b from line 12a

12c

.

.

.

13a. Net Alaska alternative minimum tax (see instructions)

.

.

.

.

.

.

.

.

.

.

.

13a

13b. Alaska incentive credits allowed against net Alaska alternative minimum tax

13b

.

.

.

.

13c. Net Alaska alternative minimum tax after Alaska incentive credits. Subtract line 13b from

13c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

line 13a

14. Net Alaska income tax. Add lines 12c and 13c

14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15. Enter 25% (.25) of the excess, if any, of line 12c over $4,500

15

.

.

.

.

.

.

.

.

.

0405-6390 Rev 01/01/15 - page 1

1

1 2

2 3

3