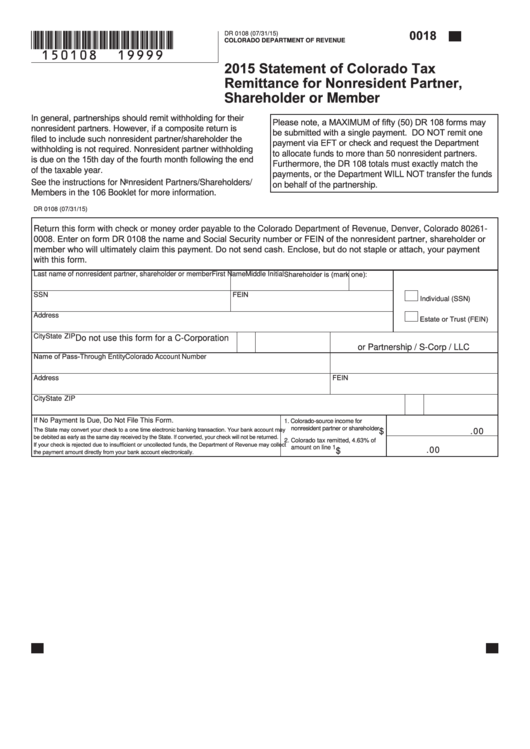

0018

*150108==19999*

DR 0108 (07/31/15)

COLORADO DEPARTMENT OF REVENUE

2015 Statement of Colorado Tax

Remittance for Nonresident Partner,

Shareholder or Member

In general, partnerships should remit withholding for their

Please note, a MAXIMUM of fifty (50) DR 108 forms may

nonresident partners. However, if a composite return is

be submitted with a single payment. DO NOT remit one

filed to include such nonresident partner/shareholder the

payment via EFT or check and request the Department

withholding is not required. Nonresident partner withholding

to allocate funds to more than 50 nonresident partners.

is due on the 15th day of the fourth month following the end

Furthermore, the DR 108 totals must exactly match the

of the taxable year.

payments, or the Department WILL NOT transfer the funds

See the instructions for Nonresident Partners/Shareholders/

on behalf of the partnership.

Members in the 106 Booklet for more information.

DR 0108 (07/31/15)

Return this form with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-

0008. Enter on form DR 0108 the name and Social Security number or FEIN of the nonresident partner, shareholder or

member who will ultimately claim this payment. Do not send cash. Enclose, but do not staple or attach, your payment

with this form.

Middle Initial Shareholder is (mark one):

Last name of nonresident partner, shareholder or member

First Name

FEIN

SSN

Individual (SSN)

Address

Estate or Trust (FEIN)

City

State ZIP

Do not use this form for a C-Corporation

or Partnership / S-Corp / LLC

Name of Pass-Through Entity

Colorado Account Number

FEIN

Address

City

State ZIP

If No Payment Is Due, Do Not File This Form.

1. Colorado-source income for

The State may convert your check to a one time electronic banking transaction. Your bank account may

nonresident partner or shareholder

$

.00

be debited as early as the same day received by the State. If converted, your check will not be returned.

2. Colorado tax remitted, 4.63% of

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect

amount on line 1

.00

$

the payment amount directly from your bank account electronically.

1

1