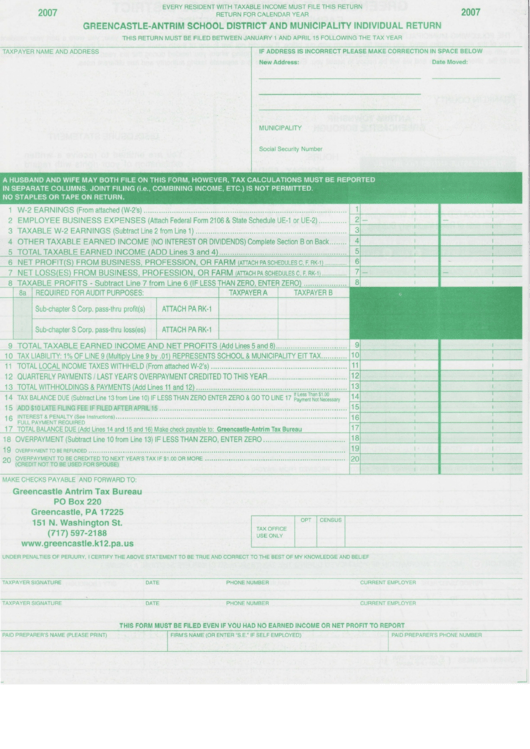

Greencastle-Antrim School District And Municipality Individual Return - 2007

ADVERTISEMENT

2007

EVERY RESIDENT WITH TAXABLE INCOME [/UST FILE THIS RETURN

RETURN FOR CALENDAR YEAB

GREENCASTLE.ANTRIM SCHOOL DISTRICT AND MUNICIPALITY INDIVIDUAL RETURN

THIS RETURN MUST BE FILED BETWEEN JANUABY 1 AND APRIL 15 FOLLOWING THE TAX YEAR

2007

TAXPAYER NAIVE AND ADDRESS

New Address:

M U N I C I P A L I T Y

Social Security Number

W-2 EARNINGS (From attached

(W-2's)

...........

EMPLOYEE BUSINESS EXPENSES (Attach

Federal

Form 2106 & State Schedule

UE-1 or UE-2).............

TAXABLE W-2 EARNINGS (Subtract

Line 2 from Line 1) ............

OTHER TAXABLE EARNED INCOME (N0 INTEREST

OR DIVIDENDS)

Complete Section B on Back........

IF ADDRESS IS INCORRECT PLEASE MAKE CORRECTION IN SPACE BELOW

Date Moved:

1

z

4

1 1

I Z

I J

1 4

I O

1 7

4 ) . . .

6 NET PROFIT

F R O M B U S I N E

PROFESSION OR FARM

PA SCHEDULES C. F. RK.1

7 N E T L

F R

FARM

PA SCHEDULES C. F. RK

I TAXABLE PROFITS - Subtract Line 7 from Line 6

LESS THAN ZERO ENTER

9 TOTAL TAXABLE EARNED INCOME AND NET PROFITS

Lines 5 and

10 TAX LIABILITY:

1%

EIT TAX

TOTAL LOCAL INCOME TAXES WITHHELD

(From altached W-2's) ............

QUARTERLY

PAYMENTS

/ LAST YEAR'S OVERPAYMENT

CREDITED

TO THIS YEAR..,.............

TOTAL WITHHOLDINGS

& PAYMENTS

(Add Lines 11 and 12)

TAX BALANCE

DUE (Subtract Line 13 from Line 10) lF LESS THAN ZERO ENTER ZERO & cO TO LINE 17 [h?:llft3,ti.?3*u"

ADD $10 LATE FILING FEE IF FILED AFIEH APRIL 15

INTEFEST & PENALTY (See Instructions) . .. .. .. .

FULL PAYI\,IENT REOUIRED

TOTAL BALANCE DUE

Tax Bureau

18 OVERPAYMENT

(Subtract

Line 10 from Line 13) lF LESS THAN ZERO, ENTER 2ER0............

1 9 o v r n p e v v e n r T o B E R E F U N D E D

2 0 O V E R P A Y N / E N T

T O B E C H E D I T E D

T O N E X T Y E A R ' S T A X I F $ 1 . 0 0 O R | \ , 4 O R E

. . . , . . . . . . . . .

- -

( C F E D I T N O T T O B E U S E D F O R S P O U S E )

M A K E C H E C K S P A Y A B L E A N D F O R W A R D T O :

Greencastle Antrim Tax Bureau

PO Box 220

Greencastle, PA 17225

151 N. Washington St.

(71715s7-2188

www. greencastle. kl 2.pa.us

UNDER PENALTIES OF PERJURY, I CERTIFY THE ABOVE STATEMENT TO BE TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE AND BELIEF

REQUIRED FOR AUDIT PURPOSES:

Sub-chapter

S Corp, passlhru profit(s) ATTACH PA RK-1

Sub-chapter

S Corp. passthru loss(es)

TAX OFFICE

U S E O N L Y

TAXPAYER SIGNATURE

DATE

P H O N E N U M B E R

CURRENT EMPLOYEFI

TAXPAYEB SIGNATURE

DATE

P H O N E N U [ , 4 B E R

C U R R E N T E M P L O Y E R

THIS FORM MUST BE FILED EVEN IF YOU HAD NO EARNED INCOME OR NET PROFIT TO REPORT

FIRI\,I'S NAME (OR ENTER'S.E." IF SELF EMPLOYED)

I

I

I

PAID PREPARER'S NAME (PLEASE PRINT)

PAID PREPARER'S PHONE NUI\,IBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2