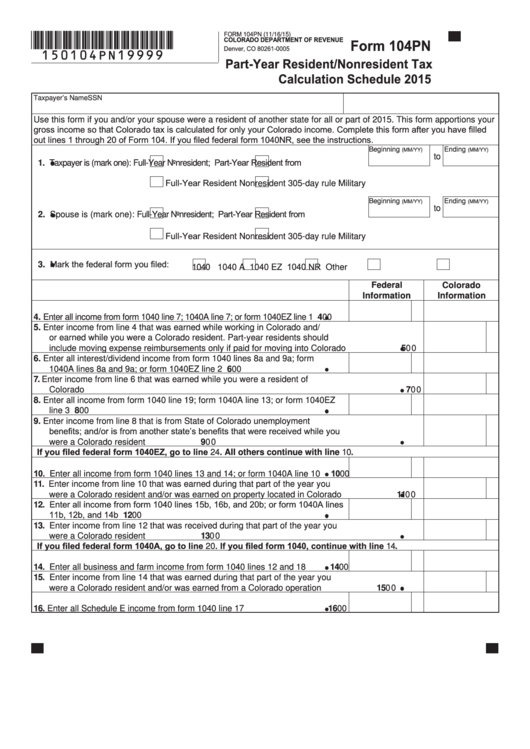

FORM 104PN (11/16/15)

*150104PN19999*

Form 104PN

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Part-Year Resident/Nonresident Tax

Calculation Schedule 2015

Taxpayer’s Name

SSN

Use this form if you and/or your spouse were a resident of another state for all or part of 2015. This form apportions your

gross income so that Colorado tax is calculated for only your Colorado income. Complete this form after you have filled

out lines 1 through 20 of Form 104. If you filed federal form 1040NR, see the instructions.

Beginning

Ending

(MM/YY)

(MM/YY)

to

Part-Year Resident from

1.

Taxpayer is (mark one):

Full-Year Nonresident;

Full-Year Resident

Nonresident 305-day rule Military

Beginning

Ending

(MM/YY)

(MM/YY)

to

Part-Year Resident from

2.

Spouse is (mark one):

Full-Year Nonresident;

Full-Year Resident

Nonresident 305-day rule Military

Mark the federal form you filed:

3.

1040 NR

1040

1040 A

1040 EZ

Other

Federal

Colorado

Information

Information

4. Enter all income from form 1040 line 7; 1040A line 7; or form 1040EZ line 1

4

00

5. Enter income from line 4 that was earned while working in Colorado and/

or earned while you were a Colorado resident. Part-year residents should

include moving expense reimbursements only if paid for moving into Colorado

5

00

6. Enter all interest/dividend income from form 1040 lines 8a and 9a; form

1040A lines 8a and 9a; or form 1040EZ line 2

6

00

7.

Enter income from line 6 that was earned while you were a resident of

Colorado

7

00

8. Enter all income from form 1040 line 19; form 1040A line 13; or form 1040EZ

line 3

8

00

9. Enter income from line 8 that is from State of Colorado unemployment

benefits; and/or is from another state’s benefits that were received while you

were a Colorado resident

9

00

If you filed federal form 1040EZ, go to line 24. All others continue with line 10.

10. Enter all income from form 1040 lines 13 and 14; or form 1040A line 10

10

00

11. Enter income from line 10 that was earned during that part of the year you

were a Colorado resident and/or was earned on property located in Colorado

11

00

12. Enter all income from form 1040 lines 15b, 16b, and 20b; or form 1040A lines

11b, 12b, and 14b

12

00

13. Enter income from line 12 that was received during that part of the year you

were a Colorado resident

13

00

If you filed federal form 1040A, go to line 20. If you filed form 1040, continue with line 14.

14. Enter all business and farm income from form 1040 lines 12 and 18

14

00

15. Enter income from line 14 that was earned during that part of the year you

were a Colorado resident and/or was earned from a Colorado operation

15

00

16. Enter all Schedule E income from form 1040 line 17

16

00

1

1 2

2 3

3