4

Form 1028 (Rev. 9-2006)

Page

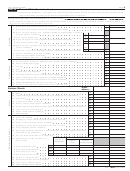

Part IV

Financial Data (See instructions.)

Complete the Statement of Receipts and Expenditures and Balance Sheets for the current year and for each of the

three immediately preceding years that the organization was in existence.

Statement of Receipts and Expenditures, for period ending

,

.

(If you prepare a statement of receipts and expenditures that is more descriptive and detailed than the statement below, you

may submit that statement instead of this one.)

1

1

Gross dues and assessments from members

2

2

Gross dues and assessments from affiliated organizations

3a

Gross amount derived from activities related to organization’s exempt

3a

purpose (attach schedule)

3b

(

)

3c

b

Less cost of goods sold

4a

4a

Gross amount from other business activities (attach schedule)

4b

(

)

4c

b

Less cost of goods sold

5a

Gross amount received from sale of assets, excluding inventory items

5a

(attach schedule)

5b

(

)

5c

b

Less cost or other basis and sales expense of assets sold (attach schedule)

6

6

Interest, dividends, rents and royalties

7

7

Other receipts (attach schedule)

8

Total receipts—Add lines 1 through 7 in far right column

8

9

9

Compensation of officers, directors, and trustees (attach schedule)

10

10

Other salaries and wages

11

11

Interest

12

12

Rent

13

13

Depreciation and depletion

14

14

Dues and assessments to affiliated organizations

15

15

Other expenditures (see instructions—attach schedule)

16

16

Patronage dividends (see instructions—attach schedule)

17

17

Total expenditures—Add lines 9 through 16

18

Excess of receipts over expenditures (line 8 less line 17)

18

Enter

Beginning date

Ending date

Balance Sheets

dates

19

19

Cash

20

20

Trade notes and accounts receivable (less allowance for bad debts)

21

21

Inventories

22

22

Investments (attach schedule)

23

23

Other current assets (attach schedule)

24

24

Depreciable and depletable assets (less accumulated depreciation/depletion)

25

25

Land (net of any amortization)

26

26

Other assets (attach schedule)

27

Total assets

27

28

28

Accounts payable

29

29

Mortgages, notes, bonds payable in less than one year

30

30

Other current liabilities (attach schedule)

31

31

Mortgages, notes, bonds payable in one year or more

32

32

Other liabilities (attach schedule)

33

Patronage dividends allocated in noncash form, other than capital stock and

33

interest-bearing obligations

34

Per-unit retains allocated in noncash form

34

Number of shares

35

Capital stock (enter numbers at

Number of

end of year):

Issued for

Issued as

shareholders

money

patronage benefits

35a

a

Voting preferred stock

35b

b

Nonvoting preferred stock

35c

c

Voting common stock

35d

d

Nonvoting common stock

36

36

Paid-in or capital surplus

37

37

Retained earnings (attach schedule)

38

(

)

(

)

38

Less cost of treasury stock

39

Total liabilities and capital

39

1028

Form

(Rev. 9-2006)

1

1 2

2 3

3 4

4