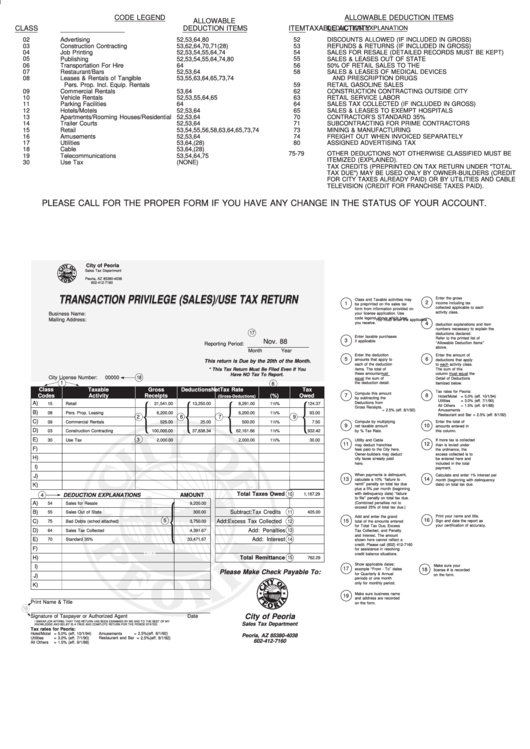

Transaction Privilege (Sales)/use Tax Return - State Of Arizona

ADVERTISEMENT

CODE LEGEND

ALLOWABLE DEDUCTION ITEMS

ALLOWABLE

CLASS

TAXABLE ACTIVITY

DEDUCTION ITEMS

ITEM

DEDUCTION EXPLANATION

02

Advertising

52,53,64,80

52

DISCOUNTS ALLOWED (IF INCLUDED IN GROSS)

03

Construction Contracting

53,62,64,70,71(28)

53

REFUNDS & RETURNS (IF INCLUDED IN GROSS)

04

Job Printing

52,53,54,55,64,74

54

SALES FOR RESALE (DETAILED RECORDS MUST BE KEPT)

05

Publishing

52,53,54,55,64,74,80

55

SALES & LEASES OUT OF STATE

06

Transportation For Hire

64

56

50% OF RETAIL SALES TO THE U.S. GOVERNMENT

07

Restaurant/Bars

52,53,64

58

SALES & LEASES OF MEDICAL DEVICES

08

Leases & Rentals of Tangible

53,55,63,64,65,73,74

AND PRESCRIPTION DRUGS

Pers. Prop. Incl. Equip. Rentals

59

RETAIL GASOLINE SALES

09

Commercial Rentals

53,64

62

CONSTRUCTION CONTRACTING OUTSIDE CITY

10

Vehicle Rentals

52,53,55,64,65

63

RETAIL SERVICE LABOR

11

Parking Facilities

64

64

SALES TAX COLLECTED (IF INCLUDED IN GROSS)

12

Hotels/Motels

52,53,64

65

SALES & LEASES TO EXEMPT HOSPITALS

13

Apartments/Rooming Houses/Residential

52,53,64

70

CONTRACTOR’S STANDARD 35%

14

Trailer Courts

52,53,64

71

SUBCONTRACTING FOR PRIME CONTRACTORS

15

Retail

53,54,55,56,58,63,64,65,73,74

73

MINING & MANUFACTURING

16

Amusements

52,53,64

74

FREIGHT OUT WHEN INVOICED SEPARATELY

17

Utilities

53,64,(28)

80

ASSIGNED ADVERTISING TAX

18

Cable T.V.

53,64,(28)

75-79

OTHER DEDUCTIONS NOT OTHERWISE CLASSIFIED MUST BE

19

Telecommunications

53,54,64,75

ITEMIZED (EXPLAINED).

30

Use Tax

(NONE)

TAX CREDITS (PREPRINTED ON TAX RETURN UNDER "TOTAL

TAX DUE") MAY BE USED ONLY BY OWNER-BUILDERS (CREDIT

FOR CITY TAXES ALREADY PAID) OR BY UTILITIES AND CABLE

TELEVISION (CREDIT FOR FRANCHISE TAXES PAID).

PLEASE CALL FOR THE PROPER FORM IF YOU HAVE ANY CHANGE IN THE STATUS OF YOUR ACCOUNT.

City of Peoria

Sales Tax Department

P.O. Box 4038

Peoria, AZ 85380-4038

602-412-7160

TRANSACTION PRIVILEGE (SALES)/USE TAX RETURN

TRANSACTION PRIVILEGE (SALES)/USE TAX RETURN

Enter the gross

Class and Taxable activities may

2

1

income including tax

be preprinted on the sales tax

collected applicable to each

form from information provided on

activity class.

Business Name:

your license application. Use

code legend above which type

Mailing Address:

You must enter the applicable

you receive.

4

deduction explanations and item

numbers necessary to explain the

17

deductions declared.

Enter taxable purchases

Refer to the printed list of

Nov. 88

3

if applicable

‘‘Allowable Deduction Items’’

Reporting Period:

above.

Month

Year

Enter the deduction

Enter the amount of

5

6

amounts that apply to

deductions that apply

This return is Due by the 20th of the Month.

each of the deduction

to each activity class.

* This Tax Return Must Be Filed Even If You

items. The total of

The sum of this

these amounts must

column must equal the

Have NO Tax To Report.

City License Number:

00000

18

equal the sum of

Detail of Deductions

1

8

the deduction detail.

itemized below.

Class

Taxable

Gross

Deductions

Net

Tax Rate

Tax

Tax rates for Peoria:

Compute this amount

Codes

Activity

Receipts

(%)

Owed

7

8

(Gross-Deductions)

Hotel/Motel

= 5.0% (eff. 10/1/94)

by subtracting the

Utilities

= 3.0% (eff. 7/1/90)

A)

Deductions from

{ { {

{

15

Retail

21,541.00

13,250.00

8,291.00

1

1

⁄

%

124.37

2

All Others

= 1.5% (eff. 9/1/88)

Gross Receipts.

Amusements

= 2.5% (eff. 8/1/92)

B)

08

Pers. Prop. Leasing

6,200.00

6,200.00

1

1

⁄

%

93.00

2

Restaurant and Bar

= 2.5% (eff. 8/1/92)

2

6

7

9

C)

09

Commercial Rentals

525.00

25.00

500.00

1

1

⁄

%

7.50

Compute by multiplying

Enter the total of

2

9

10

net taxable amount

amounts entered in

D)

Construction Contracting

100,000.00

37,838.34

62,161.66

1

⁄

%

932.42

03

1

by % Tax Rate.

this column.

2

E)

3

30

Use Tax

2,000.00

2,000.00

1

1

⁄

%

30.00

Utility and Cable T.V.

If more tax is collected

2

11

12

may deduct franchise

than is levied under

F)

fees paid to the City here.

the ordinance, the

Owner-builders may deduct

excess collected is to

H)

city taxes already paid

be entered here and

here.

included in the total

I)

payment.

J)

When payments is delinquent,

Calculate and enter 1% interest per

13

14

calculate a 10% ‘‘failure to

month (beginning with delinquency

remit’’ penalty on total tax due

K)

date) on total tax due.

plus a 5% per month (beginning

Total Taxes Owed

10

with delinquency date) ‘‘failure

1,187.29

4

DEDUCTION EXPLANATIONS

AMOUNT

to file’’ penalty on total tax due.

A)

54

Sales for Resale

9,200.00

(Combined penalties not to

{

exceed 25% of total tax due.)

B)

55

Sales Out of State

300.00

Subtract: Tax Credits

11

425.00

Print your name and title.

Add and enter the grand

16

5

15

C)

Add: Excess Tax Collected

12

Sign and date the report as

75

Bad Debts (sched attached)

3,750.00

total of the amounts entered

for Total Tax Due, Excess

your certification of accuracy.

D)

Add: Penalties

13

64

Sales Tax Collected

4,391.67

Tax Collected, and Penalty

and Interest. The amount

E)

70

Standard 35%

33,471.67

Add: Interest

14

shown here cannot reflect a

credit. Please call (602) 412-7160

F)

for assistance in resolving

1954

credit balance situations.

H)

Total Remittance

15

762.29

Show applicable dates:

Make sure your

I)

17

example ‘‘From - To’’ dates

18

license # is recorded

Please Make Check Payable To:

for Quarterly & Annual

on the form.

J)

periods or one month

only for monthly period.

K)

Make sure business name

19

and address are recorded

Print Name & Title

on the form.

16

City of Peoria

Signature of Taxpayer or Authorized Agent

Date

I SWEAR (OR AFFIRM) THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY

Sales Tax Department

KNOWLEDGE AND BELIEF IS A TRUE AND COMPLETE RETURN FOR THE PERIOD STATED.

Tax rates for Peoria:

P.O. Box 4038

Hotel/Motel

= 5.0% (eff. 10/1/94)

Amusements

= 2.5%

(eff. 8/1/92)

Peoria, AZ 85380-4038

Utilities

= 3.0% (eff. 7/1/90)

Restaurant and Bar

= 2.5%

(eff. 8/1/92)

602-412-7160

All Others

= 1.5% (eff. 9/1/88)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1