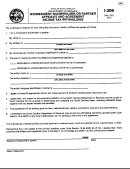

INSTRUCTIONS

NONRESIDENT BENEFICIARY AFFIDAVIT AND AGREEMENT

INCOME TAX WITHHOLDING

Requirement to Make Withholding Payments

Code Section 12-8-570 requires a trust or an estate to withhold taxes at a rate of 7% on each nonresident beneficiary's

share of South Carolina taxable income.

Purpose of Affidavit

Effective June 15, 1998, a trust or estate is not required to withhold taxes with regard to any nonresident beneficiary who

submits this completed affidavit and agreement. Any income tax due must be paid by the unextended due date of the

nonresident beneficiary's return and is subject to the declaration of estimated tax rules.

Where and When to Execute This Affidavit

Beneficiary Instructions:

A nonresident beneficiary should fully complete the affidavit and submit it directly to the trust or estate. The affidavit is

valid for subsequent years and should not be resubmitted.

Trust or Estate Instructions:

The trust or estate must remit all affidavits to the South Carolina Department of Revenue.

Attach all affidavits to Form SC1041 (Fiduciary Income Tax Return) or Form SC8736 (Request for Extension of Time to

File South Carolina Tax Return for Fiduciary and Partnership) on or before the fifteenth day of the fourth month following

the close of the trust or estate's tax year.

Affidavits remain valid for subsequent tax years and must only be filed with the Department of Revenue in the first year

that the nonresident beneficiary submits an affidavit to the trust or estate.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to

use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201

mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers,

as prescribed, for securing proper identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

Our Internet address is:

33462029

1

1 2

2