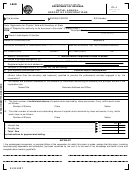

INITIAL ANNUAL REPORT - CL-1

LLCs: Do not complete CL-1 unless you are taxed as a Corporation.

You must submit a CL-1 and a $25 minimum license fee to the Secretary of State if you are a domestic corporation filing your

initial Articles of Incorporation, or a foreign corporation filing an Application for Certificate of Authority to Transact

Business in South Carolina. Make all payments payable to the Secretary of State. The Secretary of State cannot process a

CL-1 that is not accompanied by Articles of Incorporation or an Application for Certificate of Authority to Transact

Business.

If you have not already submitted a CL-1 and a $25 minimum license fee to the Secretary of State, submit them to the

Department of Revenue within 60 days after commencing business in South Carolina or using a portion of your capital in this

State. Make the payment payable to the SC Department of Revenue and mail to: SC Department of Revenue, License and

Registration Unit, Columbia, SC 29214-0140.

The minimum fee of twenty-five ($25.00) dollars must be paid at the time such report is filed.

Interest is due at the prevailing federal interest rate if this return is not filed within 60 days after commencing business in

this state.

Late filing of this return will incur a delinquent penalty of 5% per month not to exceed 25%.

Late payment of the license fee will incur a penalty of 1/2% per month not to exceed 25%.

Address Definitions: Each of these are self explanatory. The mailing address for tax correspondence will be used if

information related to your taxes must be sent to you.

LINE INSTRUCTIONS

Federal Employer Identification Number (FEIN) - If this number has not been obtained, write "applied for" or "to be applied

for" in the space provided. The FEIN can be applied for and obtained via the Internet, directly from the IRS Web site

24 hours a day, 7 days a week. Business owners or their tax professional representative can enter "EIN" as a

keyword to begin the process. While the Internet is the preferred method for applying for EIN's, business owners may still

obtain EIN's via telephone by calling 1-800-829-4933 from 7:30 a.m. to 5:30 p.m. in their local time zone, or by mailing or

faxing Form SS-4, as provided in the form's instructions.

Line 2 - If year end date has not been established, write "not known" in the space provided. December will be selected by the

Department of Revenue.

Line 5 - If principal office is not in existence at the time of filing, write "not established" in the space provided.

Line 6 - If business has not started at the time of filing, state expected date. Also include the effective date of incorporation with

the Secretary of State.

Line 8 - If all of these positions have not been filled, please indicate and provide names and positions known at the time of filing.

Line 10 - If no shares have been issued at the time of filing, please indicate.

Special Instructions for Limited Liability Companies Taxed for Income Tax Purposes as Corporation and Professional or

Other Associations Taxed for Income Tax Purposes as Corporations.

If your organization is either a limited liability company or an association taxed for income tax purposes as a corporation,

some of the terms used in this form may require a reading suited to your organization. As examples:

1.

"Corporation" should be interpreted to mean limited liability company or association;

2.

"State of incorporation" should be read to mean state of organization;

3.

"Shareholders" should be interpreted to mean members;

4.

"Director" or "officer" should be interpreted to mean manager or managing member; and

5.

"Incorporator" should be read to mean person forming the association or limited liability company.

Sections requesting certain information such as number of shares of stock may not apply to your organization and should be

so indicated.

31342025

1

1 2

2