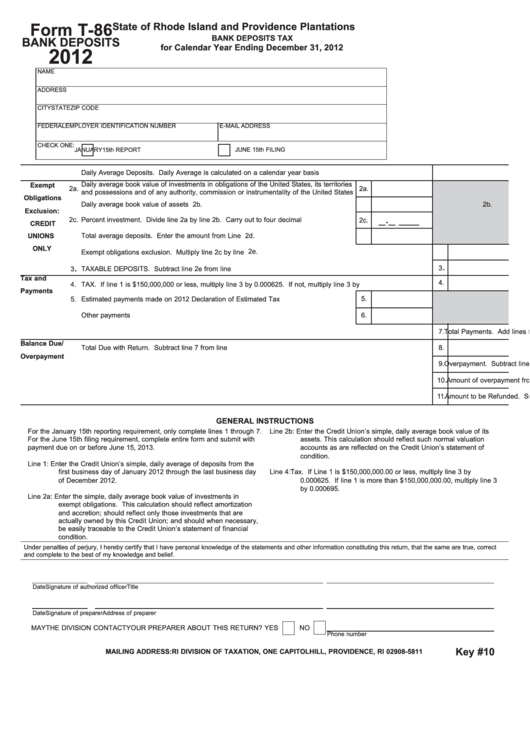

State of Rhode Island and Providence Plantations

Form T-86

BANK DEPOSITS TAX

BANK DEPOSITS

for Calendar Year Ending December 31, 2012

2012

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

E-MAIL ADDRESS

CHECK ONE:

JANUARY 15th REPORT

JUNE 15th FILING

1.

Daily Average Deposits. Daily Average is calculated on a calendar year basis ............................................................

1.

Daily average book value of investments in obligations of the United States, its territories

Exempt

2a.

2a.

and possessions and of any authority, commission or instrumentality of the United States

Obligations

2b.

Daily average book value of assets .......................................................................................

2b.

Exclusion:

_._ _ _ _

2c.

Percent investment. Divide line 2a by line 2b. Carry out to four decimal places..................

2c.

CREDIT

2d.

2d.

Total average deposits. Enter the amount from Line 1..........................................................

UNIONS

ONLY

2e.

2e.

Exempt obligations exclusion. Multiply line 2c by line 2d...............................................................................................

.

.

3

TAXABLE DEPOSITS. Subtract line 2e from line 1........................................................................................................

3

Tax and

4.

4.

TAX. If line 1 is $150,000,000 or less, multiply line 3 by 0.000625. If not, multiply line 3 by 0.000695........................

Payments

5.

5.

Estimated payments made on 2012 Declaration of Estimated Tax .......................................

6.

Other payments .......................................................................................................................

6.

7.

Total Payments. Add lines 5 and 6 .................................................................................................................................

7.

Balance Due/

8.

8.

Total Due with Return. Subtract line 7 from line 4...........................................................................................................

Overpayment

9.

Overpayment. Subtract line 4 from line 7........................................................................................................................

9.

10.

Amount of overpayment from line 9 to be applied to estimated tax for calendar year 2013 ..........................................

10.

11.

Amount to be Refunded. Subtract line 10 from line 9.....................................................................................................

11.

GENERAL INSTRUCTIONS

For the January 15th reporting requirement, only complete lines 1 through 7.

Line 2b: Enter the Credit Union’s simple, daily average book value of its

For the June 15th filing requirement, complete entire form and submit with

assets. This calculation should reflect such normal valuation

payment due on or before June 15, 2013.

accounts as are reflected on the Credit Union’s statement of

condition.

Line 1:

Enter the Credit Union’s simple, daily average of deposits from the

first business day of January 2012 through the last business day

Line 4:

Tax. If Line 1 is $150,000,000.00 or less, multiply line 3 by

of December 2012.

0.000625. If line 1 is more than $150,000,000.00, multiply line 3

by 0.000695.

Line 2a: Enter the simple, daily average book value of investments in

exempt obligations. This calculation should reflect amortization

and accretion; should reflect only those investments that are

actually owned by this Credit Union; and should when necessary,

be easily traceable to the Credit Union’s statement of financial

condition.

Under penalties of perjury, I hereby certify that I have personal knowledge of the statements and other information constituting this return, that the same are true, correct

and complete to the best of my knowledge and belief.

Date

Signature of authorized officer

Title

Date

Signature of preparer

Address of preparer

MAY THE DIVISION CONTACT YOUR PREPARER ABOUT THIS RETURN? YES

NO

Phone number

Key #10

MAILING ADDRESS: RI DIVISION OF TAXATION, ONE CAPITOL HILL, PROVIDENCE, RI 02908-5811

1

1